In 2022, American hospitals lost a projected $68 billion on billing mistakes, wrong codes, rejected claims, and lost payments majorly from in-house systems. That is not a typo. That’s the high cost of problems in a system that struggling with complexity, labor shortages, and regulatory overload

For thousands of healthcare providers, the solution has come into focus: outsource the entire billing function. What began as a cost-saving measure for small clinics is now a systemic shift across hospitals, physician groups, and specialty practices. By 2033, the U.S. medical billing outsourcing market is projected to hit $46.17 billion, up from $15.8 billion in 2024, reflecting a compound annual growth rate (CAGR) of 12.00%. That’s not a side trend. It’s a wholesale migration of back-office healthcare operations to firms that are faster, cheaper, and, crucially, better equipped to handle the chaos.

Keeping the Lights On: In-House Billing No Longer Pays Its Own Way

Hospitals are not going bankrupt because doctors are failing. They’re buckling under the cost of simply staying open. Billing staff salaries, rising health benefits, IT infrastructure, office rent, compliance training-all these make running an in-house revenue cycle team a heavy fixed expense. For many providers, it’s unsustainable.

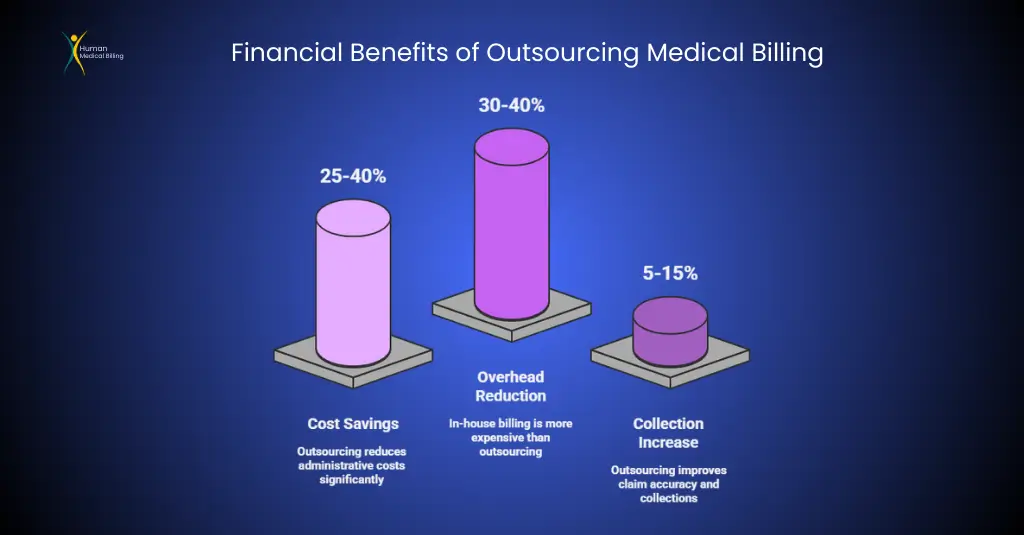

One report estimates in-house billing is 30–40% more costly than outsourcing. Third-party billing firms spread the cost among numerous clients, spend a great deal on cloud technology, and typically charge a fee per claim or a flat monthly fee, which is beneficial in revenue fluctuations. Suppose a cloud platform costs a practice somewhere between $300 a month. A server-based platform? Up to $8,000 annually. And that doesn’t account for extra IT support and staff training.

When patient volume slackens-holidays, off-peak seasons, or pandemics-providers with internal employees are stuck paying idle wages or letting workers go. Outsourcing removes that uncertainty, leveling the bottom line. Additionally, outsourcing firms will often provide scalable solutions that adjust to the size of a provider, so they’re not paying too much during slow periods or understaffed during busy periods.

Complexity is not an issue - it's the norm.

Medical billing is controlled by numerous regulations, such as HIPAA, CMS, ACA, MACRA, OIG, and payer contracts. Providers must accommodate annual coding updates (in 2024, 395 new ICD-10 codes and 230 CPT codes)

Occasional updates in CMS guidelines (such as telehealth coverage and new E&M documentation guidelines), and audit risk (CMS identified $25.1 billion in improper Medicare payments in 2022).

For in-house personnel, compliance is similar to running a clinic and having to accommodate complex tax law.

Outsourcing does it all differently. Compliance is the vendor’s job. Specialized billing companies have compliance officers who continually track and issue reminders on rules to all their clients.

This is a safety net which prevents expensive errors and audits. A California pediatric practice described the advantage in simple terms: “We didn’t outsource to save time. We outsourced to stop losing money every time CMS changed a rule.”

Outsourcing firms are most likely to provide clear audit trails and reporting, and this puts the providers at ease regarding CMS or payer audits. The clarity provides a simple way to identify and correct any issues, and this reduces financial risk further

Outsourcing firms are more equipped than you are.

Outsourcing firms possess one additional structural advantage: technology and size. Since billing companies have so many patients, they are able to invest in the best automation and software that most private practices cannot.

Examples include robotic process automation (RPA), machine learning, advanced analytics, and integrated EHR interfaces. They speed up billing and detect errors that manual processes would not.

Automation: RPA can carry out routine tasks (e.g., data entry, sending claims, and small edits) much more quickly and accurately than people. Specialists estimate that 30–50% of routine billing work can be automated. In fact, RPA and AI assist outsourcing partners reduce claim errors by as much as 75% and processing time by approximately 50%. Analytics and AI.

Outsourcers apply data analytics to identify denial trends, underpayments or delayed payments. For instance, predictive algorithms may identify high-risk accounts to deny so that employees may rectify them ahead of time.

Advanced RCM firms, according to one industry report, employ “machine learning and artificial intelligence to maximize billing process efficiency and reduce errors,” achieving greater accuracy than in-house staff could readily duplicate.

Integrated platforms: Top vendors integrate seamlessly with most popular EHR and practice management systems. This allows claims data to move easily, and payment data can be appended automatically as well. Otherwise, the small practice may use spreadsheets or outdated software requiring manual transfers. Outsourcers’ efficient standard procedures and expert IT fix the majority of delays.

With these technologies, outsourced billing usually processes claims more quickly. That quicker speed translates into payments being received sooner and fewer days in accounts receivable (AR). For example, says an RCM consultant, outsourcing usually translates into “fewer days in accounts receivable and a big drop in denials.”.

The Strategic Advantages of Outsourcing RCM Services

Outsourcing RCM services can be cost-effective and lead to long-term success. To begin with, it allows providers to do what they do best: take care of patients. It allows physicians and staff to spend more time on providing quality care, rather than on billing, which keeps patients happier and healthier.

Second, outsourcing allows the application of advanced data analysis for better decision-making. For instance, outsourcing firms are able to produce in-depth reports on important performance measures (KPIs) such as denial rates, accounts receivable days, and collection rates. The reports provide providers with a clear understanding of their financial performance. The data enables providers to identify areas that require improvement and make specific actions to boost their revenue.

Most importantly, outsourcing helps firms grow. As a firm grows-by growing in size, acquiring other businesses, or growing by taking on more patients-an outsourcing partner can easily scale up more services to keep pace. This adaptability in capacity enables providers to absorb change without having to spend significantly on personnel or facilities.

The HR Problem No One Likes: A Staffing Shortage in Billing

Medical billing is not only costly. It’s also a recruitment disaster. 90% of 200+ healthcare CFOs and RCM executives who participated in a 2022 survey reported billing/coding staff shortages, and nearly half of billing positions were empty.

Even when positions are filled, turnover is rampant. Industry statistics report annual turnover in RCM departments of 11% to 40%, significantly higher than the national average for similar administrative positions.

Why the turnover? Billing is grueling, stress-inducing, and ever-changing: new codes, payer-specific requirements, moving regulations. Errors cost money, and pay rarely correlates with the level of complexity.

For example, coders need to keep current on thousands of medical codes ICD-10, CPT, HCPCS while keeping claims current with payer policies. One error can result in a denied claim, holding reimbursement for weeks or months.

Outsourcing fixes this. Vendors have lots of trained staff on hand, so it is simple to replace staff. If your coder quits in the middle of a project, the outsourcing partner can easily replace staff. This isn’t convenience alone-it assists with risk management.

In addition, outsourcing firms tend to offer regular training for their staff, so they remain current on the most recent coding standards and rule changes, which can be challenging for in-house staff to accommodate

In-House Billing: A Model Past Its Expiration Date

The $68 billion wasted on billing inefficiencies is not simply a budgetary statistic; it is a system failure. It is the strongest indication yet that the in-house billing era must come to an end. In a system where every dollar matters, to keep relying on outdated, error-prone billing practices is not only a risk—it is a lack of responsibility.

Outsourcing is no longer a luxury or a afterthought anymore. It’s the foundation off financial stability in modern healthcare. Those providers who make the jump aren’t just cutting costs They’re adapting advanced technologies, scalable workforces, real-time data, and built-in compliance structures that are impossible for most in-house teams to replicate.

The projected $46 billion outsourcing market by 2033 confirms the trend. This is not a fringe movement; it’s a full-scale transition to smarter, leaner, and more resilient operations. The math is simple: outsourcing works—clinically, financially, and operationally.

Hospitals and practices don’t need more warnings. They need to act. Because every day spent clinging to a broken billing model is another day hemorrhaging money and another step closer to financial instability. The time to end in-house billing isn’t just now. It was yesterday and its long overdue.