Introduction

In the constantly changing healthcare revenue cycle management landscape, denials are a persistent issue. Each denied claim not only holds up payment but also adds to administrative workload and adversely affects cash flow.

A good denial prevention strategy ensures first-time approval of claims, saving revenue loss and enhancing efficiency. Rather than redoing denied claims, providers have to adopt preventive measures against denials prior to submission.

This guide presents a comprehensive denial prevention checklist, ensuring first-time approval and maximizing revenue.

Understanding Denial Prevention

What is Denial Prevention?

Denial prevention is a process by which medical billers and healthcare providers can prevent claim rejections from occurring in the first place. As opposed to denial management, which attempts to correct and resubmit claims, denial prevention seeks to identify and correct errors prior to submission.

Why Is Denial Prevention More Effective Than Denial Management?

- Reduces Revenue Losses – Studies indicate that 65% of denied claims are never resubmitted, resulting in a permanent loss of money.

- Minimizes Administrative Burden – Denial prevention eliminates the necessity for costly redo work and appeals.

- Improves Cash Flow – Getting claims approved faster leads to quicker payments.

- Enhances Compliance – Following payer rules lowers the chance of claim denials because of rule breaking.

- Boosts Provider Reputation – A well-functioning billing system creates trust and efficiency in a healthcare organization.

- Improves Patient Satisfaction – Rapid claim processing leads to fewer disputes and delays in medical care.

By prioritizing denial prevention, healthcare organizations can more effectively control resources, leading to improved operating results and more financial integrity.

Common Reasons for Claim Denials

It is important to know the underlying causes of claim denials in order to implement an effective denial prevention strategy. The common reasons are:

1. Eligibility & Coverage Issues

- Insurance policy lapsed or inactive

- Patient information entered in error

- Pre-authorization requirements not checked

2. Incorrect or Missing Medical Codes

- Use of outdated ICD-10, CPT, or HCPCS codes

- Coding either too high or too low, causing rejections

- Incorrect modifier utilization

3. Incomplete Documentation

- Medical necessity statement omissions

- Not having necessary doctor signatures

- Not appending supporting documents

4. Duplicate Claims

- Resubmission of a claim without resolving issues that need correction

- Sending a claim in error more than once for one service

5. Late Claim Submissions (Timely Filing Issues)

- Filing claims past payer deadlines

- Not monitoring timely filing limits for various payers

6. Coordination of Benefits Issues

- Inaccurate prioritizing of patient insurance policies for patients with multiple policies

- Inaccurate documentation of the primary and secondary payer

7. Insufficient Data in Claims

- Leaving out the proper patient identifiers, diagnosis codes, or procedure information

- Not following up with proper claims leading to excessive delays

By correcting these at the source level, providers can lower claim denials by a considerable percentage and have a healthier revenue cycle.

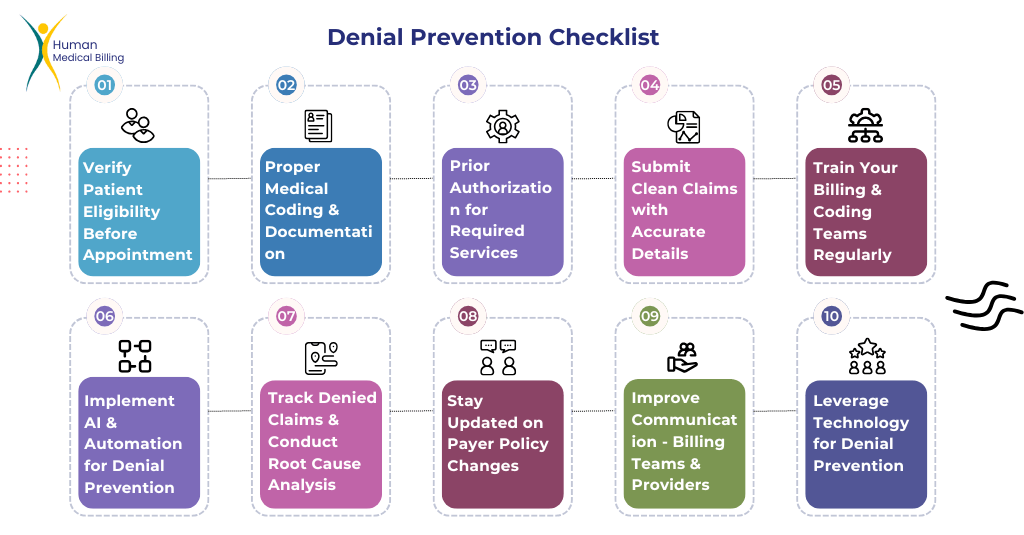

Denial Prevention Checklist: How to Secure First-Time Approval

1. Verify Patient Eligibility & Benefits Before Appointment

- Verify insurance coverage, deductibles, and co-pays.

- Review exclusions in policies and pre-authorizations.

- Make use of real-time eligibility tools.

2. Ensure Proper Medical Coding & Documentation

- Utilize the latest ICD-10, CPT, and HCPCS codes.

- Certify medical necessity for all procedures.

- Don’t use undercoding or upcoding.

- Regularly perform compliance audits.

3. Obtain Prior Authorization for Required Services

- Identify services requiring pre-approval by a payer

- Send requests for pre-approval in advance and monitor responses

- Save authorization numbers on patient accounts

4. Submit Clean Claims with Accurate Details

- Verify patient demographics, practitioner, and date of service

- Utilize automated claim scrubbing software to recognize errors

- Adhere to payer-specific submission guidelines

5. Train Your Billing & Coding Teams Regularly

- Provide quarterly coding updates training

- Utilize quality audits to recognize and eliminate trends

- Empower coders to obtain certifications for greater precision

6. Implement AI & Automation for Denial Prevention

- Utilize AI-based claim tracking systems

- Automate compliance monitoring and eligibility verification

7. Track Denied Claims & Conduct Root Cause Analysis

- Denial reasons categorize and create focused solutions

- Denial prevention protocols update according to analysis trends

8. Stay Updated on Payer Policy Changes

- Track insurance policy changes and reimbursement guidelines

- Have open communication with payer representatives

9. Improve Communication Between Billing Teams & Providers

- Create collaboration among physicians, billers, and coders

- Regular review meetings for claim improvement

10. Leverage Technology for Denial Prevention

- Utilize AI-based denial prevention tools

- Automate verification, appeals, and claim tracking

A combination of smart technology and proactive approach ensures claims are filed the first time, which minimizes stress for both patients and providers.

The Cost of Claim Denials

Denials of claims result in loss of revenue as well as affecting business. Employees waste considerable time working on denied claims, which is a diversion and detracts from higher-priority work.

Private practices and hospitals lose money when numerous claims are denied, affecting their cash flow and viability in the future. Healthcare providers lose billions of dollars annually from preventable denials, according to research.

With a well-implemented prevention strategy, organizations can deploy their resources to their full capacity, decrease stress on billers, and maintain their practice financially stable.

The Role of Data Analytics in Denial Prevention

Using data analytics helps billing departments see trends of claim denials. Organizations can see where they can improve using historical data.

Predictive analytics software gives useful insights, allowing the providers to fix common claim errors before submission.

Integrating machine learning models into billing systems can enhance the process, so that claims comply with payer rules with fewer chances of rejection.

Final Thoughts: Eliminate Denials, Maximize Revenue!

A well-designed denial prevention plan is crucial in reducing claim denials, accelerating payment, and enhancing financial performance. By adopting this denial prevention checklist, you can enhance cash flow, process efficiency, and administrative efforts.

Additionally, the adoption of data analysis and continuous monitoring can identify trends in emerging denials, which can be used to support enhanced updates of your existing strategies. Consulting with experienced revenue cycle management professionals can also enhance your capacity to effectively address claim issues.

Need professional assistance to eliminate denials? Check out our Denial Management Services for improved ways to manage your money stream! Want to eliminate denials and boost your revenue? Get in touch with us today!