Patient financial experience has become a core competitive differentiator for small medical practices. With the implementation of transparent billing, flexible payment options, and digital payment portals, practices reduce write-offs, accelerate collections by 20-30%, and improve patient satisfaction all at once. Outsourced medical billing services give small practices the technology and expertise they need to scale these improvements effectively.

Introduction: The Paradox Small Practices Face

The paradox confronting the small medical practice: Patients want to pay their bills. But 72% cite affordability as the challenge, not an unwillingness to settle their accounts. The disconnect isn't about money; it's about experience. Healthcare billing become needlessly complex, opaque, and stressful for patients. Meanwhile, your practice faces growing write-offs, delayed collections, and shrinking margins.

The solution isn't complicated. It's time to invest in patient financial experience.

When practices focus on the patient experience in billing and payment, it flips the script. Collections go up. Write-offs go down. Patients come back. In a competitive healthcare landscape where small practices are fighting to survive, patient financial experience is the new competitive advantage that separates thriving practices from those that aren't.

The Patient Expectation Shift: Retail Meets Healthcare

Patients today relate to healthcare as with any other consumer service. They expect the clarity in billing of an online retailer, the flexibility in payments of a subscription service, and accessibility to their money like a retail bank. But yet, most medical practices still run billing as if it's 2005.

Consider the numbers. As per the 2024 Healthcare Financial Experience Study, 58% of patients find paying for a healthcare bill to be stressful. That is not a small fraction; that is the majority of your patient population. Even more alarming, 47% of consumers report that their healing or well-being was negatively impacted by difficulty paying a healthcare bill.

This is not just a satisfaction issue. Patients who feel confused by bills and inflexible payment options suffer real stress that impacts health outcomes. They delay or forgo treatments. They avoid future visits. They take their business elsewhere. And they tell others about their frustration.

How Patient Financial Experience Directly Impacts Your Bottom Line

Q: Why does patient financial experience matter for practice profitability?

A: Patient financial experience directly drives collections rates and reduces write-offs. Practices that deploy transparency, flexible payment options, and accessible billing processes achieve 20-30% faster collections, while write-offs decrease from an industry average of 5-7% to 3-4%. Better patient experience accelerates cash flow while simultaneously reducing costly collection efforts.

The business case for investing in patient financial experience is powerful. Better experience leads to better collections. Better collections lead to better cash flow. Better cash flow leads to sustainable, growing practices.

1. Let's start with the write-offs.

Most small practices operate in a range of 5% to 7% of net patient revenue for write-offs. What does that mean? That's a $2 million practice writing off $100,000 to $140,000 every year. Where do those write-offs come from? Some are contractual: insurance adjustments. Some are legitimate charity care. But many stem from poor communication, unclear bills, and inflexible payment processes.

2. Pricing transparency moves the needle.

When patients get upfront estimates of the cost for services, they know what to expect. They don't get surprised by bills showing up later, nor do they disagree with charges because expectations were properly set. Studies have shown that the practices offering transparent cost estimates enjoy faster collection and fewer payment disputes.

3. Flexible payment plans prove similarly powerful.

In the Cedar 2024 study, 73% of consumers now desire payment plan options-up from 62% just two years prior. This is not a luxury request; this reflects economic reality. Patients increasingly carry high-deductible insurance plans. They shoulder more healthcare costs than ever before. A $3,000 bill due immediately creates a barrier. Spread over six payments at no interest, it becomes manageable.

4. When payment plans become standard offering, collection rates jump.

Patients who might have abandoned their bills entirely now pay gradually. You recover revenue that previously appeared as write-offs. According to the American Hospital Association, providers currently collect only 55% of patient responsibility amounts owed. Practices implementing comprehensive patient financial experience improvements consistently exceed this benchmark.

5. Think of it as revenue leakage.

Every unclear bill is potential revenue leaking out. Each confusing payment process delays collections further. Every inflexible payment option drives balances toward bad debt write-offs. Investing in patient financial experience directly seals these leaks and improves net collections.

The trend is unmistakable: patients now grade healthcare providers on three equal measures-clinical quality, care accessibility, and patient financial experience. Now, this creates an extraordinary opportunity for small practices, in particular solo practitioners and small group practices. You have the agility large health systems don't. You can implement improvements in patient financial experience faster. You can adapt to patient needs without navigating bureaucracy.

When you make billing transparent, accessible, and flexible, you signal to the patients: "We understand your situation. We make it easy to work with us." That message builds loyalty that no clinical excellence alone can achieve.

Practical Strategies Small Practices Can Implement Now

Q: What specific patient financial experience improvements can small practices implement immediately?

A: The four important strategies small practices can enact this quarter include the following: pre-visit patient responsibility estimates, digital payment portals with 24/7 access, options for flexible payment plans, and dedicated billing chat support. These altogether tend to handle the most frequent pain points for patients and normally result in a collection increase of 15-30% within 90 days.

You don't need a million-dollar technology initiative. Begin with these approaches your practice can deploy within weeks.

1. Pre-Visit Patient Responsibility Estimates

Before the appointment, calculate the patient's estimated financial responsibility. Share by email or text, or your patient portal. One simple step changes everything in the financial relationship. Patients arrive educated. They've already mentally accounted for payment. The result for many practices is a 20-30 percent improvement in same-visit collections when patients know their responsibility before they arrive.

The secondary benefit of this: compliance. The No Surprises Act, effective since 2022, requires providers to offer estimates for scheduled services. Penalties can reach $10,000 per violation. Making estimates routine protects your practice legally while improving the patient experience.

2. Digital Payment Portals and Mobile Options

Your patients bank on their phones. They pay bills with their phones. They shop with their phones. Yet many practices still mail statements and accept payment via check or phone call only. This creates friction at precisely the moment patients are ready to pay.

Digital payment portals are always on. Patients pay when it's convenient for them-midnight, Sunday morning, whatever. They see their balance, their payment history, their options in real-time. Research shows 72% of patients would likely pay immediately if they received an SMS payment link. Your barrier to payment shouldn't be operational hours. A digital portal removes that barrier.

3. Flexible Payment Plan Structures

Offer standard payment plans, perhaps three, six, or twelve-month options. Make qualification automatic based on balance size, not credit score or income verification. When patients see flexible payment options presented at point-of-billing, acceptance rates jump.

The key insight: patients want to pay. Your job is removing obstacles. Rigid payment structures create obstacles. Flexible structures remove them.

4. Dedicated Billing Chat Support

Patients have questions. "Why am I being charged this amount?" "Can I adjust my payment plan?" "What's my current balance?" These types of questions typically require phone calls. Your staff fields dozens daily. Patients wait on hold.

Deploy a chat feature on your patient portal or website. Patients ask questions in real-time. Billing staff provide immediate answers. This direct accessibility reduces frustration, speeds resolution, and improves the patient experience substantially. As a whole, many patients prefer asynchronous chat over phone anyway-they feel less rushed, less pressured.

These four strategies operate independently. Working together, they create a complete patient financial experience that is modern, truly patient-centered, and fundamentally different from competitors that are still operating in legacy billing processes.

Why Outsourced Billing Partners Are the Game-Changer

Here is the challenge small practices face: to implement improvements in patient financial experience, technology investment, staff expertise, and ongoing account management must all come together. Building this capability in-house often fails for solo practitioners and small groups operating with lean teams.

This is where outsourced medical billing services become transformative.

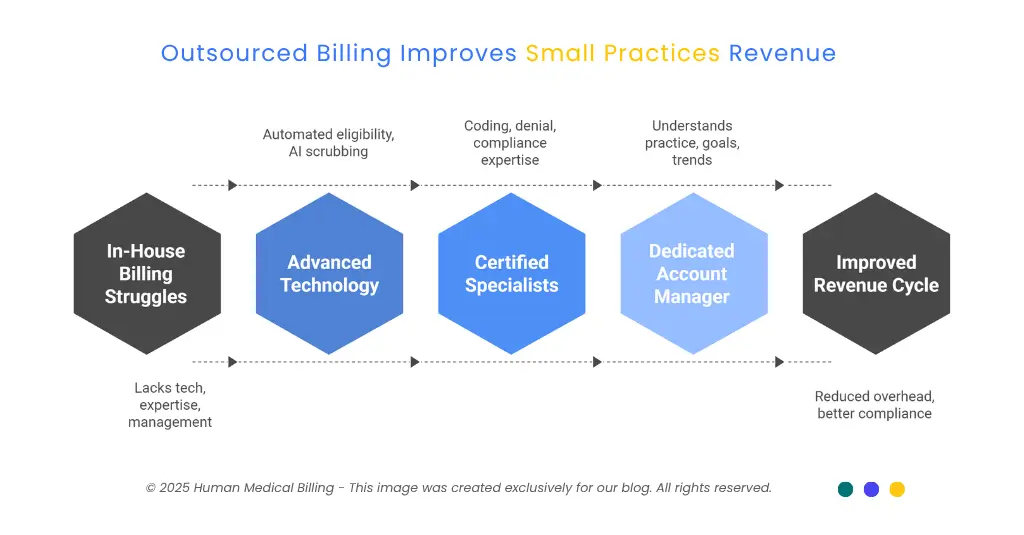

The leading medical billing companies combine three critical elements. First, they maintain advanced technology platforms: automated eligibility verification, AI-powered claim scrubbing, integrated patient portals, and real-time analytics. Second, they are staffed by certified billing specialists with deep expertise in medical coding, denial management, and compliance requirements. Third, they assign a dedicated account manager who has come to understand your practice, your specialties, and your goals.

That committed partnership matters. Technology alone will not improve your collections. Software can implement processes, but people make the difference. An experienced account manager reviews your revenue cycle metrics monthly. They identify trends, recommend adjustments, and make sure best practices are adapted to your model of practice.

Outsourced partners also remain up to date with changes in regulations. When Medicare changes its payment policy, or payer rules change, or coding guidelines change, your billing partner immediately updates the process. Your staff will be notified about the changes that are required.

Compliance stays ahead of audit risk. For small practices without dedicated compliance personnel, this expertise transfer is invaluable.

The cost structure should be considered. Small practices that try to build in-house billing departments hire full-time staff, invest in software licenses, pay for ongoing training, and absorb turnover costs. Industry data shows in-house billing operations consume 30-40% of revenue. Outsourced medical billing services usually cost 5-10% of collections, immediately reducing operational overhead while improving quality through specialist expertise.

The technology advantage particularly matters in comprehensive healthcare revenue cycle management services. A qualified billing partner maintains claim scrubbing tools that automatically identify coding errors before submission, therefore minimizing denials. They deploy AI medical billing features that predict which claims are at risk of denial, thus enabling proactive correction. They offer denial management services that systematically recover unpaid claims via appeals and resubmission.

For a small practice, this capability would cost hundreds of thousands in software and talent. With an outsourced partner, you have access to enterprise-level tools at a fraction of the cost.

Real-World Success: How One Small Practice Improved Collections by 28%

Consider Dr. Sarah Chen, who operates a solo family medicine practice in an urban area. Five years into practice, she faced a familiar problem: patient collections had stagnated. Write-offs climbed to 9% annually. Days in accounts receivable exceeded 65 days. Her staff spent enormous effort chasing payment for unpaid balances.

Initially, Dr. Chen assumed the problem was patient unwillingness to pay. She implemented aggressive collection practices-early statements, collection notices, payment demand calls. Collections barely budged. Frustration mounted.

Then she reconsidered the data. Surveys of her own patients revealed a different story: they wanted to pay but found her billing confusing. Bills arrived weeks after service. Payment options required phone calls during business hours. No payment plans existed. For patients earning hourly wages, calling during working hours meant lost income.

Dr. Chen made three changes. First, she implemented pre-visit estimates through her EHR system. Patients received bill estimates by email at appointment confirmation. Second, she added a digital payment portal and enabled SMS reminders when payments were due. Third, she authorized office staff to offer payment plans automatically on balances over $200.

Implementation took six weeks. Cost was minimal-mostly training staff on new workflows.

The results: within four months, collections improved 28%. Accounts receivable dropped to 42 days. Monthly cash flow increased $12,000 predictably. Write-offs fell to 4%. Patient satisfaction surveys showed marked improvement in billing experience ratings. Equally important, Dr. Chen's staff stopped feeling adversarial with patients about payment. Billing conversations became collaborative problem-solving instead of collections confrontation.

This success wasn't unique. It reflected a fundamental truth: patients faced barriers, not unwillingness. Remove the barriers, and payment behavior changes dramatically.

Moves to Upgrade Your Patient Financial Experience This Quarter

1. Step 1: Implement Patient Responsibility Estimates

Immediately start estimating patient responsibility for all appointments scheduled, and send via email or patient portal within 24 hours of booking. Train front desk staff to discuss the estimate during the pre-visit calls. Track same-day collection rates before and after. Most practices see 15-25% improvement in collections from this single change.

2. Step 2: Implement Digital Payment Options

If you don't have a patient portal that allows patients to make payments, prioritize this. Find a HIPAA-compliant payment option that integrates with your EHR. Allow multiple options for payment-credit cards, debit cards, ACH transfers, and mobile options. You can promote aggressively; most patients will adopt quickly because it will be so easy.

3. Step 3: Empower staff with flexible payment plans

Document standard payment plan guidelines. Train all patient-facing staff on when and how to offer plans.

Establish that payment plans are standard offering, not exceptions granted reluctantly. Remove friction from the approval process. When payment plans become normal instead of exceptional, adoption soars and collections improve.

The Competitive Edge Awaits

Patients have clear preferences. They want to pay their healthcare bills. They demand transparency about costs. They expect payment flexibility. They deserve respectful, helpful billing support. When small practices deliver on these expectations, they compete effectively against much larger health systems trapped in legacy billing process.

The practices thriving today recognized that patient financial experience isn't an administrative function-it's a competitive differentiator. They invested in healthcare revenue cycle management services that put patient needs first. They partnered with medical billing services teams focused on collections improvement rather than just claim submission. They deployed technology that made billing accessible rather than antagonistic.

Your practice can do the same. Start by auditing your current patient financial experience. How do patients perceive your billing process? Is it transparent or opaque? Flexible or rigid? Accessible or frustrating? Use that honest assessment to guide investments. Small, focused improvements compound. Better patient experience drives better collections. Better collections fund further improvements. Within quarters, your practice operates with materially better financial health and patient satisfaction.

The small medical practices winning market share this year aren't winning through clinical excellence alone. They're winning because they recognize patients as consumers with expectations shaped by every service interaction outside healthcare.

They're winning because they've made it genuinely easy to understand costs and pay bills. They're winning because they've invested in patient financial experience as a core competitive strategy

That opportunity exists for your practice too. Human Medical Billing and similar specialized partners help small practices implement this transformation systematically. The question isn't whether investing in patient financial experience makes sense. The data is conclusive: it improves both patient satisfaction and financial performance simultaneously.

The question is simply: will you start this quarter?