A number of changes are occurring in the 2026 health care environment that will impact many medical practices. Insurers are exiting the market; networks are decreasing in size; and for the first time in 10 years Medicare Advantage enrollment is expected to decrease in certain regions where payers have exited unprofitable counties.

This is what we are calling the "Great Retreat."

For patients this represents confusion; and for your front desk staff an increase in anger from frustrated patients and an increase in invalid insurance cards being presented by patients. However the risk to your organization's revenue cycle is far greater than either of these. The chaos associated with the upcoming enrollment process will create a perfect storm for an increase in claim denials that will start on January 1, 2026.

Below is an explanation of why this is going to happen and some ideas on how to minimize the financial loss prior to its occurrence.

What is the 2026 Medicare Advantage Shift?

The 2026 Medicare Advantage "shift" is an expression of the significant cost reduction strategies being implemented by large health care insurers such as Humana, Aetna and UnitedHealthcare. These carriers have been experiencing tighter government regulation and lower profit margins and are now:

- Exiting hundreds of counties (leaving 10% of MA enrollees without their current plan).

- Switching from flexible PPO style plans to rigid HMO type plans.

- Narrowing their physician networks in order to lower costs.

With this transition, millions of patients will be walking into doctor's offices in January of 2026 with a new insurance card, new restrictions on where they can receive medical services and usually, little knowledge that their Medicare Advantage coverage has changed.

1. Reason 1: The "Great Retreat" and Eligibility Chaos

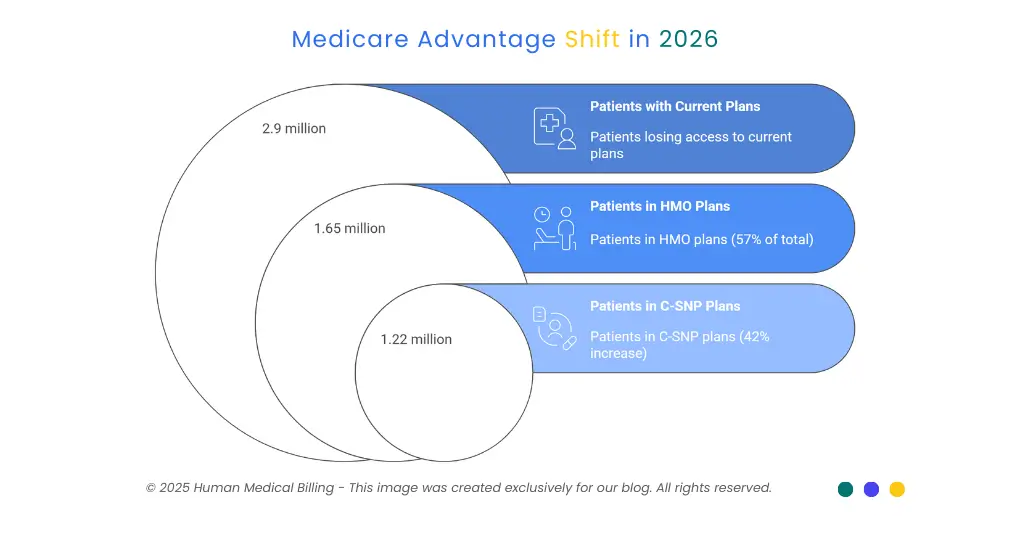

In 2026, about 2.9 million Medicare Advantage patients will no longer have access to the current plans they have when their insurer chooses to leave the area (their county). Combined, UnitedHealthcare and Humana are leaving over 300 counties.

Eligibility issues occur whenever an insurer exits a market; patients will need to quickly locate and enroll in a different plan. Often, many will be automatically enrolled into a completely unfamiliar plan.

The Billing Risk: Mr. Smith is one of your long-term patients who has been seeing you for the past five years with his UnitedHealthcare PPO plan. On January 5, 2026, he shows up to visit you again. Your front desk staff simply scans his previous card or checks him in as usual without assuming anything has changed.

- Reality: His prior insurance plan was terminated and he is now covered by an Aetna HMO plan.

- The Result: You submit a claim to UnitedHealthcare. They reject the claim since the policy is not active. You then attempt to send a claim to Aetna, however, you were unable to obtain the necessary referral since you did not realize he had switched to an HMO.

- Outcome: Lost/uncollectible revenue.

How to Fix It: Your front desk staff should never assume that all returning patients have the same insurance coverage. You MUST perform a real-time eligibility check for each Medicare patient that is coming in for their appointment. At Human Medical Billing, our healthcare revenue cycle management services include rigorous eligibility checks that catch these shifts days before the patient walks through your door.

2. Reason 2: The Silent Shift from PPO to HMO

There are a couple of ways health insurers can lower costs - the simplest method is by moving Medicare Advantage patients from Preferred Provider Organizations (PPO) to Health Maintenance Organization (HMO).

According to data for 2026, HMOs account for 57% of all Medicare Advantage plans.

So why should we care about this?

- Preferred Provider Organization (PPO): You generally can visit doctors outside your network and self-refer to specialists.

- Health Maintenance Organization (HMO): You can only visit in-network providers, and you need a referral from your PCP before seeing a specialist.

The Denial Trap: Broker agents transferred many patients to HMOs to reduce their Medicare Advantage premium costs. However, the broker agent rarely explained the rules of the HMO to their clients. For example, a client may tell you "I still have Blue Cross", when in fact, their "Blue Cross" is actually an HMO with strict access to medical services.

If a specialist accepts an HMO patient as a new patient and the specialist doesn't have a valid referral on file for that patient, that claim will be denied. It won't matter how many times you appeal the denial, the claim will remain denied.

Fact Check: According to the Kaiser Family Foundation (KFF), 15% of local PPO Medicare Advantage plans were canceled for 2026, which means millions of Medicare beneficiaries were forced into even more restricted provider networks.

3. Reason 3: The Rise of Special Needs Plans (C-SNPs)

As traditional Medicare plans shrink in size, so-called Special Needs Plans (SNPs), which focus on patients with certain chronic health conditions, such as diabetes or heart failure, have been rapidly expanding. This is due to higher Medicare reimbursement rates to insurers for this type of population.

C-SNPs (Chronic Conditions SNPs) accounted for an estimated 42% increase in 2026.

The Increasing Complexity of Coding Requirements: In order to receive payment from a C-SNP, it may be necessary to provide documentation to support the fact that the patient has one of the specific chronic conditions that the C-SNP covers. Therefore, if your coding team enters a general ICD-10 code for the patient's diagnosis instead of the specific ICD-10 code used by that C-SNP, the claim will most likely result in a denial or an audit request.

Our team at medical coding services ensures all claims we process contain the level of specificity required by each of the new and increasing complex C-SNPs.

4. Reason 4: Faster Decisions = Faster Denials (CMS Rule 0057-F)

Beginning January 2026, a new federal regulation (CMS-0057-F) that requires health insurance companies to process prior authorization requests more quickly, than they have been in the past.

Specifically:

- Standard requests: Must be decided in 7 days.

- Urgent requests: Must be decided in 72 hours.

The above appears to be in line with what you're saying; however, there's an exception. In order for insurers to meet those time limits, they'll be relying extensively upon artificial intelligence (AI) and automated algorithms. The AI will most likely deny your pending prior authorization if you miss just one required document or clinical note.

You will notice much less of "Pending" status and many more "Denied" status' than ever before.

Strategy For Success: Your practice cannot afford poor documentation. Our denial management services work in a model of "preventive defense", where we include all possible clinical documentation to support an authorization request at the time the request is made to prevent the payer's AI from having reason to deny the request.

5. Reason 5: Shrinking Supplemental Benefits

Insurers have been using a variety of methods for many years to attract seniors into their Medicare Advantage plans by offering them a variety of benefits such as gym memberships, dental benefits and OTC (over-the-counter) debit cards. Insurers eliminated these extras in 2026 to protect their margins.

Collection Problem: Seniors were used to their insurance paying for all their medical needs. When seniors discover they now owe money for a service that was previously paid for by their insurance or when they discover their deductible has increased, they become unhappy. Collecting from patients is statistically far more difficult than collecting from payers.

You must have an aggressive yet empathetic collection process if you wish to keep your bad debt down. You must hire a team that can clearly explain the 2026 benefit reductions to patients and collect the payment owed to you.

6. The Bottom Line: Don't Face 2026 Alone

This year’s Medicare Enrollment Period is different from years prior - it is going to be a fundamental transformation of how Medicare Advantage operates. Insurers are looking out for their own interests - now is the time to look out for yours.

You can’t do things the way they’ve always been done. The room for error is gone.

- You will need to verify each patient's eligibility prior to each visit.

- You will need to accurately code each C-SNP service.

- You will have to fight the wave of AI-generated denials.

Human Medical Billing was designed specifically for environments like the one you’re in right now. We not only handle your claims but serve as a barrier against the chaos of the insurance industry for you. If you need our medical credentialing services to gain access to the new narrow networks or if you want an all-in-one AI-based medical billing solution to improve your cash flow - we can help.

Next Steps

Don’t allow the “Great Retreat” to harm your bottom-line revenue. Get in touch with us today for a no-cost audit of your current billing performance. Make 2026 the best year yet for your practice in spite of everything else going on.