How Medicare Advantage Denials Are Fueling a Healthcare Crisis

More than half of Medicare-eligible individuals are in MA plans by 2025. While plans were designed to enhance care options, they are now more closely tied to severe issues confronting healthcare providers.

A sharp spike in claim denials most often for medically necessary care has now begun to undermine provider revenue, inundate clinical workflows, and complicate the delivery of patient care.

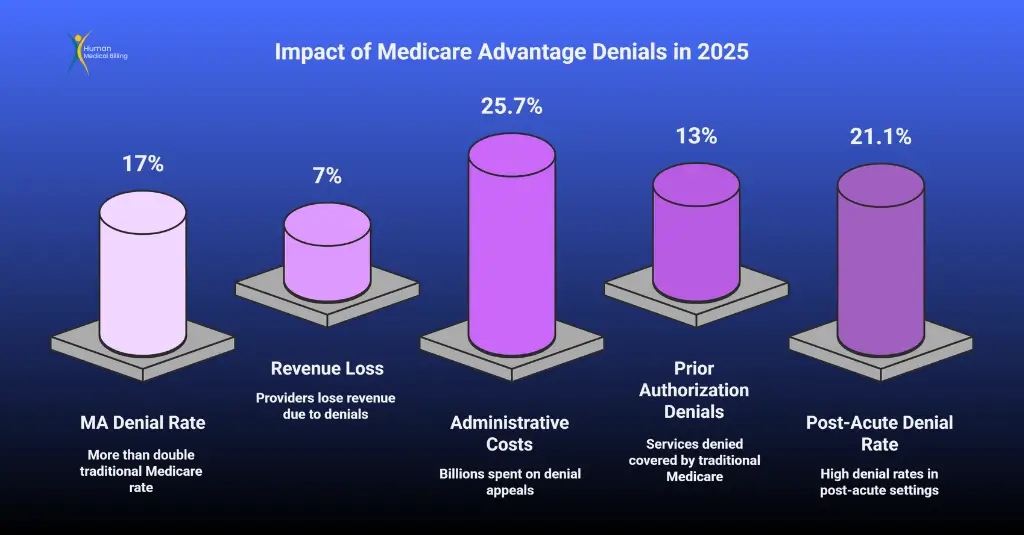

- U.S. healthcare providers lost 7% of revenue in 2024 due to denied claims despite over half being overturned on appeal.

- Administrative costs to dispute MA denials have soared to over $25 billion.

- Smaller practices and rural hospitals are at breaking point.

- Medicare Advantage (MA) denial rates now top 17%, more than double traditional Medicare.

Experts are calling for urgent legislative reform and better utilization of revenue cycle management (RCM) strategies.

Medicare Advantage Denial Rates Are Escalating Rapidly

Denial Rates Are 2X Higher Than Traditional Medicare

Recent analysis reveals that Medicare Advantage plans deny roughly 17% of submitted claims more than double the denial rate under traditional Medicare, which stands at 8%.

Denials related to prior authorization requests have also surged, rising from 5.8% in 2021 to 7.4% in 2022.

The data point to a mounting administrative burden, with wide-ranging financial consequences for provider organizations.

Financial Fallout: A 7% Revenue Hit for Providers

Revenue Losses Are Just the Tip of the Icebere. Despite the fact that 57% of initial denials are later overturned on appeal, the net effect remains significant: an estimated 7% reduction in Medicare Advantage-related revenue.

High-cost services especially in post-acute and outpatient care tend to be targeted more frequently. In post-acute settings alone, denial rates reach as high as 21.1%, further intensifying financial stress in sectors already under strain.

Resource Allocation Challenges

In 2023, health organizations paid an estimated $25.7 billion for claims adjudication. Interestingly, Medicare Advantage appeals make up a much larger percentage of these costs.

The cost of appealing one Medicare Advantage denial averaged a staggering $63.76, compared to a paltry $0.79 for plain Medicare, reflecting the complex and time-consuming nature of such appeals.

Administrative Costs Are Surging

Staff time constitutes the greatest share of denial management costs, with labor representing nearly 90% of the cost.

With increasing amounts of time spent by billing staff handling appeals, clinical and operational processes are disrupted. Denial management has in most cases become a focal activity of provider revenue cycle functions.

Implications for Clinical Care

Prior Authorization and Delays in Treatment

Administrative requirements associated with Medicare Advantage plans have become a notable source of treatment delays.

Approximately 13% of denials involved services that would have been covered under traditional Medicare, reflecting a divergence in utilization criteria between program types

Providers cite 45 to 60 days of holdup as they work their way through the required appeals or seek other avenues.

- Delays in diagnostic imaging

- Interruptions in rehabilitative care

- Denials of durable medical equipment

Effects on Critical Care Settings

Emergency rooms and post-acute facilities are hit the hardest. These facilities are generally expected to provide care before reimbursement is confirmed.

Therefore, denials of claims after treatment expose organizations to uncompensated care expenses, which further burden institutional resources.

Medicare Advantage Denials Are Undermining Care

Decline in Liquidity

Reimbursement delays are driving liquidity issues throughout the industry. In 2023, hospitals had 196.8 days in cash available on hand a 10-year low. The metric is directly related to increased payment lag due to increasing appeal cycles.

Smaller practices and rural hospitals are at breaking point

Small practices and rural health providers lack administrative staff to pursue lengthy appeals. So, some are choosing to reduce or even opt-out of participating in Medicare Advantage altogether, which can limit patient access in medically underserved communities.

Regulatory Efforts Are Under Pressure

CMS Has Responded - But Is It Enough?

CMS’s 2024 final rule attempted to restrict the use of prior authorizations and reduce delay windows.

The 2025 proposed rule goes further mandating equity audits and more granular denial transparency. But many say it doesn’t go far enough.

Providers still report that CMS enforcement lacks teeth, and MA plans continue to prioritize financial denial metrics over clinical judgment.

The Economic Fallout of Denials

Facilities are now facing denial rates of nearly 20%, with some even seeing rates of up to 49% on certain services.

This dilemma forces providers to hold higher cash reserves or rely on credit lines to bridge the gap between providing services and settling claims.

This setting has resulted in hospital consolidation and market consolidation

Final Thoughts on Medicare Advantage Denials

since individual providers cannot compete or maintain services under existing denial pressure

To survive, healthcare providers are adopting Revenue Cycle Management Services to manage denials, speed up appeals, and automate claims tracking.

Medicare Advantage Denials in 2025 are not arbitrary-they’re systematic. high denial rates, excessively lengthy delays, and unstable approval patterns have caused an RCM crisis that’s harming providers and patients alike.

While appeals succeed, 57% of the time, loss through denial is actual and on the rise. And while CMS policy is evolving, loopholes in enforcement remain.

The solution is easy: invest in intelligent denial management, track the performance of every payer, and work with service providers who understand the MA environment