The cost to patients will be much higher with the coming Medicare 2026 law as well as the new permanent rules for virtual care. Changes in this law will have an immediate effect on the financial bottom line for all private practice owners, clinic managers, and hospital executives. You need to make adjustments now to your billing workflow to minimize the increase in bad debt due to Medicare 2026's increased costs to patients.

The Medicare Part B premium in 2026 is projected to be $202.90 and the deductible is set at $283. Inpatient Part A costs will increase to $1,736 for CMS. Also, CMS has permanently authorized virtual direct supervision for the vast majority of services and has eliminated the limits for follow-up visits from hospitals and nursing facilities through virtual means.

Therefore, to keep profits high, clinics should utilize medical billing services that can assist them with collecting more money from their patients and assist with the new virtual coding rules.

Medicare 2026 costs:

Medicare 2026 will be shifting the majority of the cost burden on your patients shoulders.

Irrespective of whether you are operating a single specialty practice or a multi-specialty hospital, you can expect to see increased balances due from the patient side.

- Part B Premium: $202.90 monthly (increased from $185.00)

- Part B Deductible: $283.00 (increased from $257.00)

- Part A Inpatient Deductible: $1,736.00 (increased from $1,676.00)

- Skilled Nursing Daily Coinsurance: $217.00 for days 21-100

Why does it matter? The patient premium has increased by nearly 10% as well as the deductible by $26. Therefore if your staff does not collect these amounts prior to processing claims, your bad debt/allowances will increase.

All private practitioners and group practice owners need to evaluate their current medical accounts receivable service providers. This would be an excellent opportunity to revise your payment plan options and point-of-service collection techniques.

2026 Medicare costs and telehealth changes

| Area | 2025 Cost / Rule | 2026 Cost / Rule |

|---|---|---|

| Part B Premium | $185.00 | $202.90 |

| Part B Deductible | $257.00 | $283.00 |

| Part A Deductible | $1,676.00 | $1,736.00 |

| Visit Limits | Caps on SNF/Inpatient visits | Frequency caps removed |

| Direct Supervision | Mostly in-person | Virtual via video allowed |

Telehealth rules that stick in 2026

CMS has implemented many temporary COVID-19-related policies that are no longer in effect. Many of the temporary flexibilities in the 2026 Physician Fee Schedule will become permanent.

Here are the specifics:

- Frequency limits: CMS removed caps on subsequent inpatient and nursing facility telehealth visits.

- Virtual Supervision: Doctors can now supervise "incident-to" services via real-time audio-video. This excludes surgeries with a 010 or 090 global period.

- Teaching Doctors: Residents can be supervised virtually across all training sites for telehealth services.

- RHCs and FQHCs: These facilities can continue billing for medical telehealth through the end of 2026.

The new CMS rules will allow your office to provide additional patient visits and potentially add fewer employees on site. From an overall perspective, with respect to the medical billing services aspect, you will have more opportunities to bill for hospital and clinic-based telemedicine services as well as additional medical billing options.

How higher Medicare costs hit your billing

Higher deductibles shift liability from payer to patient. The result is that your billing team will be working harder to collect from patients.

Practice manager’s next steps:

- Confirm coverage: Confirm the $283 deductible level with each patient prior to their appointment.

- Educate staff: Inform patients of the 2026 Medicare increases so they are not surprised.

- Tech: Provide electronic payment options (e.g., Text to Pay, Card on File).

Front Desk Script: Explaining the $283 Deductible:

"Beginning in 2026, the centers for medicare & medicaid services (cms) has increased the medicare part b deductible from $275 to $283. As your deductible has not been met as of today's visit, your liability for today's visit will be [amount]. Do you wish to pay the deductible using a card on file, or would you prefer to establish a flexible payment plan?"

Human medical billing provides all of the necessary services to manage the front-end of the revenue cycle for your healthcare practice. Our goal is to provide you with accurate estimates to keep your cash flow steady. For more information about the benefits of our services.

Using telehealth to protect revenue

Telemedicine provides you with an opportunity to hold onto scheduled appointment times when rising cost of care results in lost appointments.

- No more caps: Based on a hospitalist's or specialist's clinical needs rather than an artificial count, they are now able to use technology for scheduling virtual follow-up visits with patients.

- Broaden your scope of practice: Utilize virtual supervision to enable your physicians to supervise across different sites.

- Updated Coding Guide: Ensure that your medical coding services team is aware of the current 2026 telehealth list.

You are required to track denials that occur due to the new requirements of your billing team. These items should then be inputted into your denial management services to avoid repeating errors. If you are utilizing an ai medical billing tool, ensure the tool has been updated to reflect 2026 supervision and telehealth requirements prior to relying solely on automated coding.

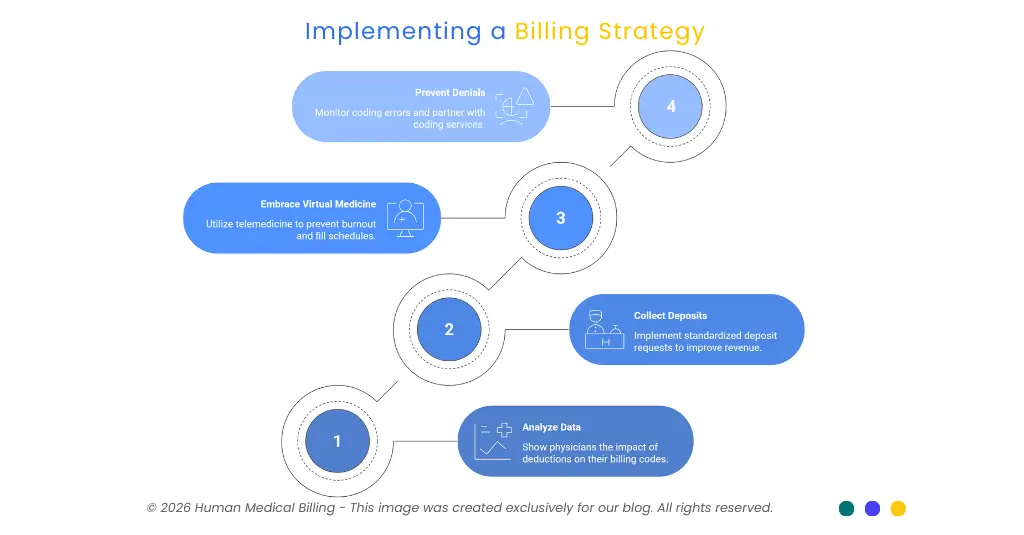

A billing strategy for physicians and owners:

Physicians would like to spend time with their patients, not with the collection of payments. Here is an easy way to use this strategy in your next staff meeting:

1. "We have 2026 data.":

Show the physicians what will be deducted from their patient's Part B benefits ($283) and their monthly premiums ($202.90). Explain how these charges affect the physician's top 10 billed codes.

2. "We are smarter about collecting.":

Ask for deposits from patients as soon as they are eligible for services using your healthcare revenue cycle management services. It can help you implement standardized deposit requests across your entire organization.

3. "We work within virtual medicine.":

Take advantage of the current telemedicine supervision rules so that your physicians can work virtually, which can help to prevent burnout and keep the schedule full.

4. "We stop denials before they start.":

Create a dashboard to monitor Medicare 2026 coding errors. Create a partnership with our medical coding services to ensure you maintain an accurate level of documentation.

Where credentialing and AR fit

Your telehealth strategy will fail if your provider is not properly enrolled. Medical credentialing services assist with keeping your PECOS records up-to-date; this is a necessity for new NP’s or PA’s that have been added to your practice group.

Review your medical accounts receivable service to make sure it follows up on patient balances promptly. Check out the FAQs for information on common questions regarding Medicare payment cycles.

What to do next as a practice:

- You need to update your patient intake forms with the new 2026 rates.

- You should review your telehealth documentation templates for the new supervision rules.

- Please contact Human Medical Billing to learn how our service will work for you.

Read our success stories to see how we can help a multi-specialty groups. Contact us- we are ready to help you succeed in 2026.