Medical billing services cost California providers more than in most U.S. states due to high staffing expenses, strict Knox-Keene Act compliance, and Medi-Cal’s unique filing rules. Understanding these costs is critical for practices navigating California’s complex regulatory environment while trying to keep collections strong and overhead low.

TL;DR:

In 2025, medical billing services cost California providers an average of 3–8% of monthly collections or $3–$10 per claim. Outsourcing is typically 30–40% cheaper than maintaining in-house billing staff and raises net collection rates to 90–95%. Costs vary by specialty, payer mix, and location, with cardiology, orthopedics, and neurology trending 1–2% higher.

Practices in the Los Angeles, San Diego, and San Francisco regions routinely reimburse at a higher rate due to increased staffing costs and more complex payer protocols. At a rate of 12–20%, Denials are also present and outsourcing denial administration recovers up to 90% of claims compared to 60–70% in house.

Quick Answer

Medical billing services cost California providers 3–8% of monthly collections or $3–$10 per claim. Outsourcing typically reduces overall expenses by 30–40%, boosts collection rates to 90–95%, and strengthens compliance in a state known for its complex payer mix and high staffing costs.

Average Medical Billing Costs in California:

- Quick Fact: Most billing companies in California charge 4–7% of collections.

- Small practices spend ~$40k annually.

- Mid-sized groups $80k–$240k

- Large groups can exceed $1M annually.

| Pricing Model | Typical Range | Best For |

|---|---|---|

| % of Collections | 3–8% | All practice sizes |

| Per Claim | $3–$10 | High-volume specialties |

| Flat Fee | $1k–$15k+/month | Large groups |

Outsourcing vs. In-House Billing in California:

Quick Fact: Outsourcing saves 30–40% compared to in-house billing.

In-House Billing Costs (Annual):

- Solo practice: $75k–$125k

- Small practice: $200k–$330k

- Medium practice: $300k–$500k

Outsourced Billing Costs (Annual):

- Solo practice: $25k–$40k

- Small practice: $75k–$105k

- Medium practice: $160k–$240k

In Los Angeles, San Francisco, and San Diego, outsourcing is especially cost-effective due to higher staffing and real estate overhead.

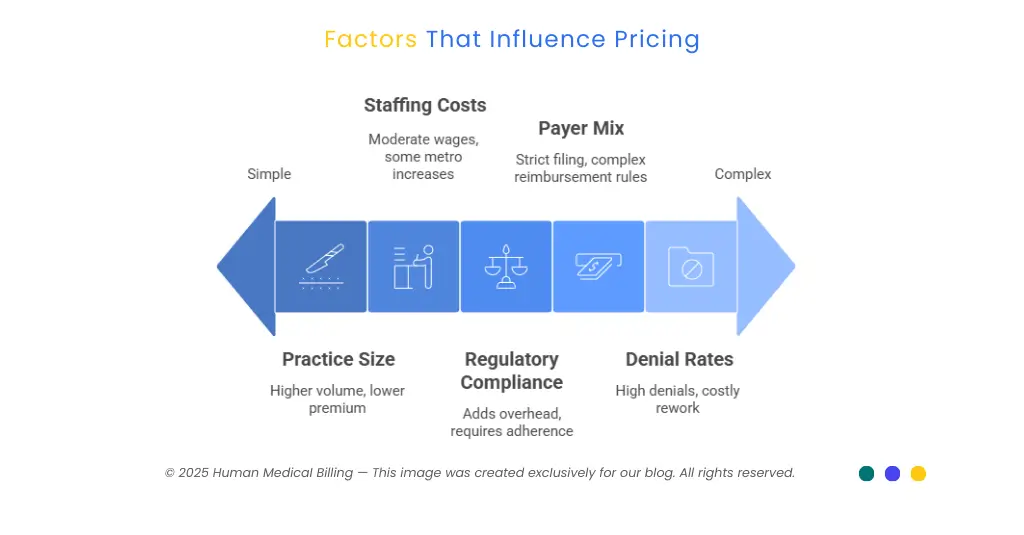

Factors That Influence Pricing:

- Practice Size & Specialty – Pediatrics and primary care = higher volume; Cardiology, orthopedics, neurology, and emergency medicine = +1–2% premium.

- Payer Mix – Medi-Cal requires strict 6-month filing with TAR/SAR; Blue Shield & Anthem have complex reimbursement rules.

- Denial Rates – CA practices see 12–20% denials; each denied claim costs $57–$118 to rework.

- Regulatory Compliance – Knox-Keene Act, HIPAA, and CCPA add compliance overhead.

- Staffing Costs – Billing specialists earn $42k–$66k annually; LA/SF metro areas push wages to $30+/hour.

Geographic Cost Variations in California:

- Premium Markets (4–7% of collections): San Francisco Bay Area, Los Angeles Metro, San Diego.

- Standard Markets (3–6% of collections): Central Valley, Inland Empire, Sacramento.

The Hidden Cost of Denials in California:

Denials are a significant driver of the cost of medical billing services California practices experience. Throughout specialties, denial percentages range from 12–20%, and left unmanaged, drain up to 25% of total collection. Internal teams recover an average of only 60–70% of denied claims, while offsite billing partners recover an average of 85–90% by utilizing payer-specific knowledge.

The issue is most evident in payer data: UnitedHealthcare marketplace insurance denies nearly one in every three, Anthem Blue Cross averages 23%, and Kaiser Permanente lower at about 6%. Medi-Cal managed care insurance is the most unpredictable and has hard-and-fast authorization rules that need specialized knowledge.

Case Studies: California Practices Reducing Costs:

One pediatric clinic in Los Angeles County that has five doctors once paid about $135,000 annually for in-office billing. Outsourcing at a 5% collections rate decreased their cost by $90,000 per year, for direct cost savings of $45,000 and a secondary $180,000 in incremental revenues for improved collections.

Similarly, a 12-physician practice of internal medicine in San Francisco reduced billing costs by 35% through outsourcing. The move increased annual net collections by $280,000, giving a staggering 312% ROI in the first year.

Advanced Technology and AI Integration:

- Automated Coding Assistance: Reduces coding errors 30–50%, speeds claim submission 40%.

- Predictive Denial Management: Identifies high-risk claims before submission.

- RPA: Eliminates manual tasks, improves accuracy to 99%+.

While AI may add $1–2 per claim, it reduces denials and improves cash flow.

2025 Trends Affecting Costs:

- Value-Based Care: More quality reporting and risk adjustment coding.

- Medi-Cal Updates: Stricter provider documentation, new Rx policies.

- Federal Changes: ICD-11 prep and telehealth billing.

- AI Regulation: New compliance requirements for automation.

How to Choose the Right Billing Partner in California:

| What to Look For | Red Flags to Avoid |

|---|---|

| Medi-Cal TAR/SAR expertise | Extremely low rates (<3%) |

| Knox-Keene compliance knowledge | Hidden fees |

| Local payer experience (Blue Shield, Anthem, Medicare Advantage) | Long-term contracts |

| HIPAA + CCPA-compliant infrastructure | Poor communication |

| Transparent SLAs (24–48 hr submission, denial response in <10 days) | Outdated technology |

| Real-time reporting dashboards | — |

How Human Medical Billing Keeps Costs Affordable

The price of billing service for California pay in 2025 is influenced by practice size, specialty complexity, payer mix, and California's highly compliant environment. With median fees of 3–8% of collections or $3–$10 per claim, practices that maintain billing in-house often have hidden expenses. from labor and investment in technology to increased denial rates. Outsourcing, by definition, provides a reliable 30–40% cost savings, achieves clean claim rates of 95%, and improves net collections by 10–15% in the first 90 days.

In the case of California practices, it isn't a question of whether or not outsourcing is cheaper, it's a question of what company has the right knowledge. A billing firm that possesses Medi-Cal TAR/SAR knowledge, Knox-Keene licensure, and payer specifics can be the determinant of leakage or consistent growth. Providers from Los Angeles, San Francisco, and San Diego specifically thrive from outsourcing, where staffing costs and payer sophistication make internal billing teams much less efficient.

We've invested over 20 years assisting California practices make billing into a scalable, predictable revenue engine. Our customers enjoy reduced operating expenses, quicker reimbursements, and improved compliance results - all without long-term agreements.

Frequently Asked Questions

3–8% of collections or $3–$10 per claim.

Yes. Most practices save 30–40% by outsourcing.

Yes. Medi-Cal, Knox-Keene, HIPAA, and CCPA add compliance overhead.

Cardiology, orthopedics, neurology, and emergency medicine.

Many see results in 30–60 days, with full benefits in 90 days.

Typically 4–7% of collections or $5–$10 per claim.