Let's get right to the most important question: is insurer downcoding legal?

It appears that the issue of whether insurer downcoding is legal is more complicated than a straightforward yes or no. While insurers do have a right to review claims for fraud or “upcoding,” the new, aggressive tactic of using artificial intelligence to automatically downcode claims by the thousands - often without a human reviewer looking at the medical record – is now being contested and, in some states, made illegal.

Many physicians and their offices are experiencing a decrease in revenue despite a stable volume of patients. Some of those physicians are on the front lines of a new financial war.

Physicians submit a claim for a complex visit, complete with supporting documentation. Weeks later, the physician receives a check representing only a fraction of what he or she expected. That is an example of an insurer downcoding the original claim. This is an example of an automated, algorithm-based attack on the financial well-being of your practice.

There is good news: physicians and state lawmakers are fighting back. Below is the story of that battle, and how it will affect your practice and what you can do about it.

What is Insurer Downcoding?

Before physicians and their staff can begin to fight back, the terms used to describe the enemy need to be defined.

Insurer downcoding is when an insurance company lowers the amount paid to a physician for a medical service by reducing the billing code for the service to one that has a lower reimbursement rate.

To illustrate how this works:

- A physician performs a Level office visit (CPT code) that takes 5 minutes.

- The physician’s staff prepares a claim for the office visit and submits it to the insurer, along with the patient’s medical record, showing a Level office visit.

- The insurer uses an artificial intelligence (AI) program to scan the claims data. Without reading the actual medical records, the AI program determines that the visit was “too simple” and automatically changes the billing code for the visit to a Level visit.

- The insurer then pays the physician for the Level visit and reduces the physician’s earnings.

This process forces physicians into an excessive and burdensome appeals process. It's a key part of denial management services, many physicians and their staffs do not pursue the appeals because they feel the effort to recover the lost revenue outweighs the value of the additional revenue.

This process is particularly damaging for physicians whose offices rely heavily on Evaluation and Management (E/M) codes.

Why is This Occurring Now? The Use of AI for Downcoding

The problems associated with insurer downcoding dramatically increased in 5 as several major insurers such as Cigna and Aetna implemented policies to automatically downcode E/M services.

The insurers use of proprietary algorithms to determine the downcoded level of service is the heart of the controversy. The insurers claim they are attempting to target “fraudulent upcoders.” However, physicians claim the insurers are unfairly penalizing them for honest billing practices.

According to AHIP, the insurers trade association, these programs are a necessary evil in order to prevent waste and abuse in the medical billing process. AHIP points to federal studies regarding “coding intensity” to support their claims. Additionally, AHIP is actively lobbying against federal bills such as the “No UPCODE Act”, which could restrict the insurers ability to profit from the coding differences.

However, physicians on the ground view things differently.

The Provider Backlash: Why the AMA Is Fighting Insurer Downcoding

The medical community, led by the American Medical Association (AMA), describes this automated downcoding of physician claims as a “furor.”

In 5, the AMA formally resolved to “vigorously oppose unilateral downcoding of evaluation and management (E/M) services by insurance companies.” The AMA resolution specifically references the new programs offered by Cigna and Aetna.

The AMA position is as follows:

- It’s a Blanket Policy: The programs are not targeted audits. They are blanket policies that punish all physicians equally.

- It Ignores Medical Records: The programs ignore the medical records related to each claim. The AMA believes it is “never acceptable to downcode claims without a review of the medical record”.

- It’s a Pay Cut in Disguise: The programs constitute a significant reduction in revenue for physicians. The AMA argues that the programs require physicians and their staff to “spend valuable time and resources filing appeals to fight for the correct payment.”

Specialty groups such as the American Academy of Sleep Medicine echoed this position. The organization stated that the policies “pose a serious threat to the long-term viability of sleep medicine practices” and create additional paperwork for physicians and their staffs, diverting resources away from patient care.

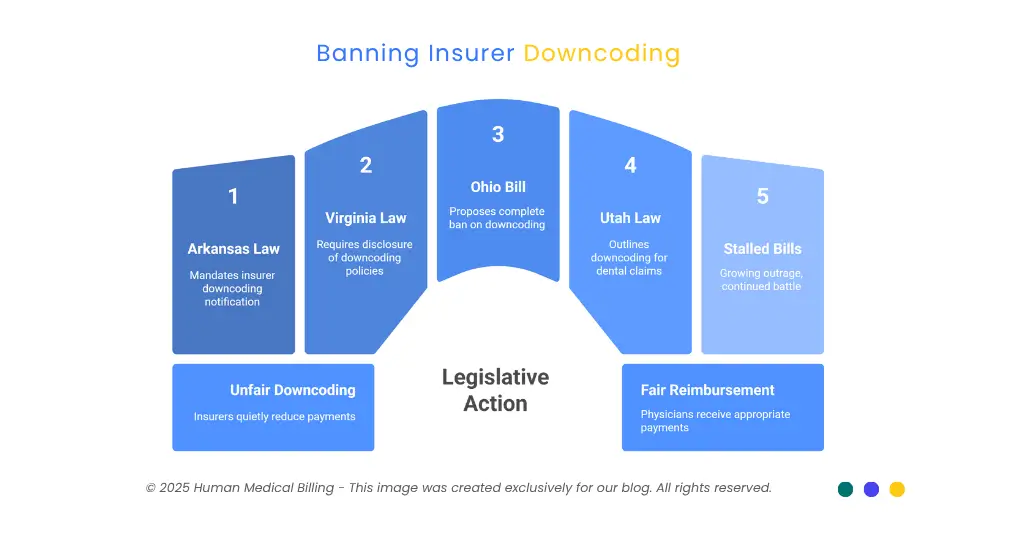

The organized provider response has transitioned from angry letters to state legislatures. As a result, multiple pieces of legislation have been introduced to answer the question, “Is insurer downcoding legal?” and definitively answer, “NO.”

The New Battleground: State Laws Banning Insurer Downcoding

As previously mentioned, the answer to the question, “Is insurer downcoding legal?” varies by state. In the following sections, a state-by-state report is presented from the frontlines of the fight to ban insurer downcoding.

1. WIN: Arkansas (Act ): Mandating Transparency

Arkansas is the first state to achieve a legislative victory in this battle.

- The Law: Act (formerly HB).

- Status: Enacted. It became effective in August.

- What It Does: The law addresses “silent” insurer downcoding. The law mandates that insurers notify the physician within 10 days of downcoding a claim.

For the first time, insurers in Arkansas cannot quietly reduce payments and expect physicians to not recognize the difference. Instead, they are required to document on the record that they reduced the payment for the physician’s services. This creates a paper trail and establishes a basis for an appeal, both of which are critical components of a successful medical accounts receivable service.

2. WIN: Virginia (Code § .-.5): Disclosure in Contracts

Virginia achieved a major success for physicians in 5. Like Arkansas, Virginia focused on accountability.

- The Law: An amendment to the Code of Virginia (§ .-.5).

- Status: Enacted. It became effective in July.

- What It Does: The law requires insurers to expose their downcoding and bundling policies to their contracted physicians. Payers must either include the information in their provider contract agreements or place it on a publicly accessible website.

If an insurer “has a routine, as a matter of policy, bundling or downcoding claims,” the law dictates that they “must clearly disclose that”. This prohibits insurers from keeping their downcoding policies secret and enables physicians and their billing services to legally contest unreasonable reimbursement rates.

3. IN-PROGRESS: Ohio (SB 5): The Outright Ban

Ohio has taken its efforts to a higher level. Instead of just requesting transparency from insurers, Ohio has proposed a complete ban on automated downcoding.

- The Bill: Senate Bill 5 (SB 5).

- Status: In Progress. The bill received its first sponsor testimony hearing in October.

- What It Will Do: The proposed legislation will prohibit insurers from automatically downcoding claims.

Backed by the Ohio State Medical Association (OSMA), SB 5 is part of a broader package of insurance-related reforms. The OSMA’s advocacy demonstrates a united front from Ohio’s medical professionals.

4. The Nuance: Utah (HB 5): A Win for Dentists, A Hope for Doctors

Utah presents an excellent case study of the specificity of these laws.

- The Law: HB 59 .

- Status: Enacted.

- What It Does: The law outlines when an insurer may employ bundling and downcoding for dental claims. The law was a huge victory for Utah dentists.

The catch is that the law does not address medical health insurance.

Therefore, Utah dentists have won the battle. Now, the Utah Medical Association (UMA) is working with the Utah Insurance Commissioner to establish similar safeguards for physicians. This illustrates that winning battles in one segment of the healthcare industry can provide a model for other segments.

5. Stalled (But Not Dead): New York, New Jersey & Connecticut

It is apparent not every state will see an initial victory for this battle; therefore, it is obvious how difficult this fight will be.

- New York: The New York State Senate is considering a bill (S) that would bar insurance company downcoding which results in "reversing or changing medical necessity determination." There has been no advancement on the part of this bill out of committee.

- New Jersey: Two measures to ban downcoding (S5/A) did not advance from their committees this year.

- Connecticut: A proposed measure (SB), designed to prevent insurance companies from using "software tools to automatically downcode" claims, was unable to advance.

Although these bills are dead, the mere fact that they were introduced shows that there is a growing national outrage. The provider groups in each of these states have agreed to meet again and continue the battle against downcoding.

| State | Bill / Law | Status | What It Does About Insurer Downcoding |

|---|---|---|---|

| Arkansas | Act 136 | Enacted | Requires 30-day notice for downcoded claims. |

| Virginia | § 38.2-3407.15 | Enacted | Mandates disclosure of downcoding policies in contracts. |

| Ohio | SB 165 | In Progress | Seeks to ban automatic downcoding entirely. |

| Utah | HB 35 | Enacted (Dental Only) | Restricts downcoding for dental claims; medical doctors are now seeking similar protections. |

| New York | S4833 | Stalled | Aimed to stop downcoding that alters medical necessity. |

| New Jersey | S54 / A1036 | Stalled | A pair of bills to ban downcoding died in committee. |

| Connecticut | SB 817 | Stalled | Aimed to ban AI and software-based downcoding. |

How Insurer Downcoding Hurts Your Practice's Bottom Line

It is not just about policy at the state level – there are consequences as to how this will affect your practice financially and your ability to care for your patients.

1. For Doctors: There is a significant impact.

- Revenue Lost: With each downcoded claim you lose money you made.

- Administrative Burden: You must take time away from your patients to “fight back” against abusive insurance companies which creates additional “administrative burdens and costs” according to the AMA – time you could spend with patients.

- Sustainability: The American Academy of Sleep Medicine has stated that these types of policies create such a burden upon the viability of sleep practices, it is true for all specialties.

2. For Patients: Patients are affected in this too.

- Tighter Scheduling: As reimbursement decreases, your doctor may be able to see fewer patients per hour.

- Service Limitations: Some services may be limited due to cost or because they are frequently downcoded.

- Chaos in Networks: Ultimately, if the abuse by the payers continues, your provider may have to leave those networks which forces your patient to seek out a new physician.

The issue of insurer downcoding is across the board for a healthcare revenue cycle management services company from the front desk to the billing office.

How To Fight Back Against Payer Downcoding (A Pro-Active Approach)

With a new and powerful tool - state laws - you cannot sit around waiting for legislators to fix this for you. You must be proactive.

What Can I Do?

1. Identify The Laws In Your State

If you are in Arkansas or Virginia, your billing staff needs to begin quoting Act and Code § .-.5 in every appeal letter immediately. Using the law as authority demonstrates to the payer you are serious and aware of your rights.

2. Audit All Of Your EOBs And ERAs

You must first identify the problem. Are you noticing a trend? Are there specific payers or CPT codes that are consistently being downcoded? That information is your ammo.

3. Contest EVERY Unjustified Downcode

You cannot allow the insurers to win by default. You must contest every single unjustified downcoding. Each of your contests must contain:

- The full medical record.

- A clearly written statement.

- A reference to the new state law, if applicable.

4. Find A Medical Billing Specialist That Understands This Battle

Here is the truth. Running medical practice is a full-time job. So is fighting abusive insurance company AI.

That is when having a dedicated partner becomes crucial to your practice.

Your practice deserves a team that understands and fights for this battle. At Human Medical Billing, this is what we do. We are not just a billing service - we are your practice's financial advocates.

When you hire us, you are not simply outsourcing your billing. You are hiring a team of experts who provide all the services required for a healthcare revenue cycle management service from start to finish.

- We Know Coding: Our medical coding specialists are certified professionals who review all of your claims to ensure they are accurate, complete and compliant before sending them to the payers. This provides algorithms with less opportunity to target your claims.

- We Master the Start: We handle your medical credentialing to ensure you are properly registered with all of the payers from the beginning to eliminate one of the most common causes of denied claims.

- We Are Your Appeals Department: When an insurer attempts to use algorithmic downcoding on your claims, we handle the denial management services process from start to finish. We write the appeals, keep track of deadlines and fight for every dollar owed to you.

- We Collect What You're Owed: Our medical accounts receivable services are relentless. We do not allow claims to expire. We continue to pursue payment on all of your outstanding claims.

The Battle for the Future of Medical Billing

The battle between medical providers and insurers over downcoded claims continues. Even though there have been some positive developments at the state level (Arkansas and Virginia), the root cause of the problem is still very much present.

You can bet that insurers will continue to develop new and better ways to lower reimbursement rates.

Your practice should not sit idly by as a victim of these insurance company tactics; instead, your practice should be proactively defending itself.

A skilled and experienced billing service can help you defend yourself and eliminate the administrative burden of fighting these complex algorithms, allowing you to focus on providing care to your patients.

Do not allow algorithms to determine your revenue.

Are you sick and tired of losing your hard-earned money due to the automatic insurer downcoding of your claims? Are you interested in learning more about how we can help you win back your lost money?

Visit our website to learn more about how our services work and to see our success stories from other practices that were in the same situation you are now in.

Contact us when you are ready to begin winning back your lost revenue.

For more information about current trends in billing and practice management, please visit our Xpert billing blog. If you have additional questions regarding your practice, please review our Frequently Asked Questions or to learn more about who we are.