Healthcare consolidation just reached a record high in Q3 2025, with physician practice managers closing 367 deals through September, dental service organizations announcing 183 transactions, and a $10 billion pharmacy acquisition that reshaped the entire industry landscape.

To medical billing professionals, practice managers, and healthcare administrators, these numbers signal something important: healthcare M&A activity is not slowing down; it's picking up.

But what does this mean for your practice? How will this consolidation affect your revenue cycle management? And what should you know about the transformation that's happening right now?

Let's break it down.

Why Healthcare M&A Exploded in Q3 2025

The third quarter of 2025 proved to be an inflection point in healthcare consolidation. Despite concerns about the One Big Beautiful Bill Act, which was passed on July 4, 2025, deal activity increased substantially from Q2 to Q3.

Three key drivers pushed this surge:

1. Medicare Payment Cuts

The Medicare physician fee schedule for 2025 cut conversion factors by 2.83%. Looking ahead, the One Big Beautiful Bill Act requires $500 billion in Medicare reductions from 2026 to 2034.

Translation: Independent practices face tighter margins.

Consolidation offers an escape route. Larger entities can absorb cuts through operational efficiency, shared infrastructure, and negotiating power they don't have alone.

2. Value-Based Care Transition:

More than 60% of health organizations now expect higher value-based care revenue in 2025. Capitated payment models have doubled since 2021, while today, 14% of all healthcare payments flow through fully capitated arrangements.

3. Value-based contracts require:

- Advanced data analytics

- Population health technology

- Financial reserves for risk-bearing

- Care coordination infrastructure

Small practices do not have such capabilities. Merger with large organizations instantly makes these requirements available

4. Private Equity Capital Availability

This suggests that roughly $75 billion in private equity dry powder remains available for healthcare deployment. Lower interest rates made acquisitions more economically attractive than in 2024.

Strategic buyers and private equity firms drove a total of 507 healthcare transactions through September 2025. Of those, 35% were in physician practice management alone.

Breaking Down the Numbers: What the Data Shows

Let's look at what actually happened in Q3 2025 across major healthcare sectors.

| Sector | Q3 2025 Activity | Key Driver |

|---|---|---|

| Physician Practice Management | 130 deals announced Q3; 367 YTD | Medicare cuts + value-based care |

| Dental Services Organizations | 183 Q3 transactions | Scale economics; 25% market consolidation target |

| Ambulatory Surgery Centers | 300+ centers now in major networks | Outpatient procedure migration |

| Behavioral Health | Multiple platform mergers announced | Mental health + substance abuse integration |

| Hospitals & Health Systems | 30+ transactions announced YTD | Geographic expansion + divestitures |

| Home Health & Hospice | Modest activity; UnitedHealth/Amedisys closed | Reimbursement uncertainty |

| Digital Health & Health IT | 26% increase YTD | AI and workflow automation demand |

What's striking? Consolidation isn't occurring in one area. It is happening everywhere at once. That suggests deep, structural change throughout healthcare delivery.

The Dental Consolidation Phenomenon: 53% of All PPM Deals

Here's a stunner: Approximately 53% of all Q3 physician practice management transactions were dental.

Dental service organizations closed 183 transactions in Q3 2025 alone. Yet the market remains only 25% DSO-affiliated, with approximately 200,000 dental practices still independent.

Why is dental consolidating so aggressively?

1. Economics of Scale

DSO-affiliated practices achieve economies by leveraging centralized procurement, shared administration, and technology infrastructure. Tuck-in acquisitions command valuations of 3x to 6x EBITDA, making acquisitions profitable for the acquiring platforms.

2. Succession Planning

Dentist-owners have retirement decisions to make. DSO partnerships create liquidity events without selling to hospitals or private equity firms. They continue practicing while gaining operational support.

3. Market Expansion

In Q3 2025, Imagen Dental Partners continued its expansion from Arizona into Washington and Kentucky. MB2 Dental announced its 800th practice location. Sage Dental expanded into South Florida. Each pursued geographic rollup strategies whereby multiple practices are combined to achieve regional density.

The DSO market projects compound annual growth of 16.4% through 2030. Consolidation is likely to accelerate as independent practitioners retire and the remaining practices are under competitive pressure.

What Q3 2025 Consolidation Means for Medical Billing Revenue Cycle Management

Consolidation changes everything in the way medical billing services function.

Here is what's actually happening:

1. Revenue Cycle Complexity Increasing

When practices consolidate, the billing systems merge. Multi-payer contracts become multi-entity contracts. Prior authorization requirements by payor and entity differ. Claim submission becomes more complex.

This is where the real pressure lies for medical billing teams. Healthcare revenue cycle management services need to be scaled up to meet increased administrative burdens.

2. Denials Spike During Integration

Practice consolidations routinely trigger claims denials during transition periods. Patient eligibility data transfers in error. Billing codes change. Provider numbers update across a multitude of systems.

Smart practices are investing in denial management services to help them navigate this risk. Proactive audits catch the errors before claims reject.

3. Credentialing Becomes Critical

With consolidation, provider credentialing becomes muddled. New entities need new Medicare provider numbers. Payer contracts need to be re-validated. Panels need to be updated.

Medical credentialing services prevent the leak in revenue during such transitions. One mistake in credentialing may delay claims for months.

4. Coding Accuracy Demands Rise

Consolidated practices face increased scrutiny from payers. Larger entities fall more readily onto the compliance radar. Coding audits increase.

Medical coding must highlight accuracy and compliance for services. For practices, this would require protocols in writing, ongoing coder education, and internal audits to stay ahead of payer scrutiny.

The Private Equity Angle: What PE Entry Means for Practices

The $10 billion sale of Walgreens Boots Alliance to Sycamore Partners, which closed on August 28, was a turning point in Q3 2025.

This was no ordinary transaction. It indicates that PE is more at ease with the consolidation of healthcare.

PE ownership usually entails the following:

1. Operational Demand for Effectiveness

PE aims to cut costs by 10–15% within 18 months of the acquisition. This frequently entails cutting back on staff, consolidating technology, and getting rid of unnecessary tasks.

PE ownership for medical billing departments entails:

- Routine process automation

- billing platform consolidation

- pressure to shorten days in accounts receivable

- investment in AI-powered denial management

Keep an eye on your revenue cycle metrics.

Private equity investors care a lot about cash conversion. So, getting your revenue cycle management and medical accounts receivable in shape isn’t just a nice-to-have - it’s how you build real value.

PE-backed practices typically implement:

- Real-time AR dashboards

- Automated claim follow-up

- Predictive analytics for denial prevention

- Provider-specific performance metrics

2. AI and Automation Investment

PE sees AI as margin expansion. AI medical billing tools automate coding, claim scrubbing, and appeals. These aren't optional anymore under PE ownership.

Practices without AI infrastructure face competitive disadvantage against PE-backed competitors.

How Consolidation Affects Payer Relationships and Reimbursement

Let's be honest, consolidation changes the leverage of negotiations between providers and payers.

Larger consolidated practices can put pressure on payer contracts; they can demand better rates, and threaten to remove service lines from networks.

However, larger practices can also attract more scrutiny.

Payers examine large practices with caution; audits increase, prior authorization requirements are tightened, and denial rates can increase when payers go to higher lengths to defend reimbursement against consolidated providers.

This creates a challenge for a consolidated practice: They are in need of more advanced services in healthcare revenue cycle management to navigate a complex payer environment.

There is no way that a more singular entity can solve this on its own. They need partners that specialize in multi-payer, payer relationships, and data analytics to support practice leaders in this evolution.

What is Healthcare Mergers & Acquisitions (M&A)?

Healthcare Mergers & Acquisitions (M&A) includes the purchase, consolidation, or, combination of healthcare organizations. In Q3 2025, there were 367 acquisitions of physician practices, 183 dental consolidations, as well as other deals in hospitals, surgery centers, behavioral health, and digital health. Healthcare M&A has been created and incentivized by cuts to Medicare payments, the movement towards value-based requirements of care, and the access to private equity capital.

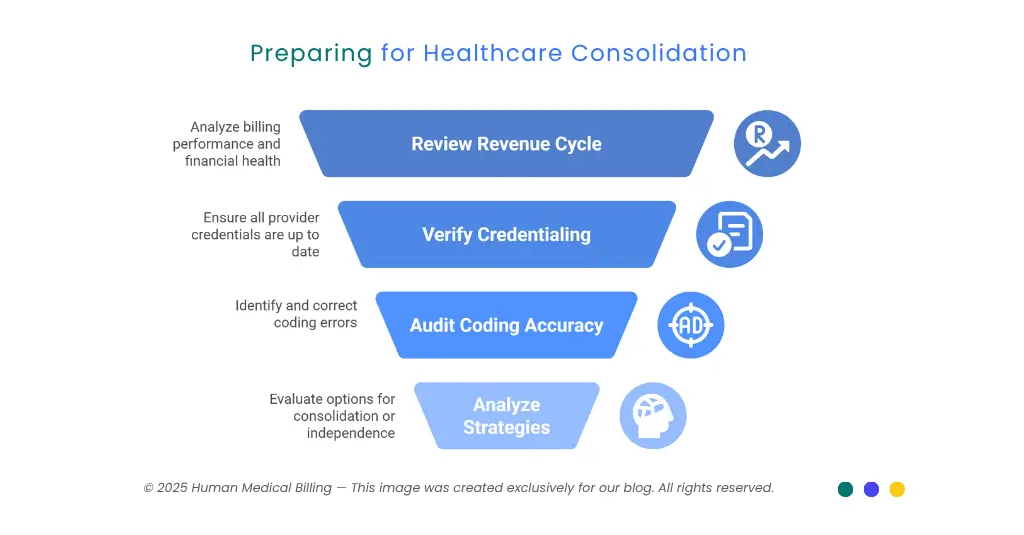

What Should Your Practice Do Right Now?

If consolidation is accelerating, how should the practice leader respond?

1. Step 1: Review Your Revenue Cycle

Understand how your billing currently is performing. Track:

- Days in accounts receivable

- Denial rates by payer

- Clean claim percentage

- Cash conversion rates

This is important baseline data. If consolidation occurs, you will want this data to aid with assessments of potential partners.

2. Step 2: Review Your Credentialing Status

Verify that all provider credentials are up to date and confirm insurance panels. Medicare and Medicaid enrollments should be active for all payers.

Credentialing challenges will arise very quickly once merger discussions begin. Make sure they are resolved now.

3. Step 3: Review Your Coding Accuracy

Conduct an internal audit of your medical coding. Look for:

- Speciality gaps in diagnosis coding

- Modifier application error

- Unbundling exposure

- Upcoding trend

Buyers evaluate coding exposure. Clean coding practices will increase acquisition value.

4. Step 4: Analyze Your Strategies

Consolidation is not required but is certainly becoming the baseline. Your strategy choices are:

- Join a DSO or PE backed platform, or other health system.

- Remain an independent practice but invest in a new billing infrastructure.

- Team up with a competent medical billing service partner relationship to improve your position.

Each pathway has advantages and disadvantages. An independence model comes with increased autonomy but the necessity of a continual investment in compliance, technology, and billing expertise.

Consolidation will provide resources but business processes require reliance on the cultures and decisions of other organizations.

How Human Medical Billing Supports Practices Through Consolidation

Organizations navigating consolidation are faced with unique complexities in healthcare. Practices will need to turn to healthcare revenue cycle management services.

Human Medical Billing provides support for practices in this regard through:

1. Denial Management During Transitions

When practice consolidates, denials will certainly occur. Our denial management service utilizes medical billing system oversight to investigate root causes and recover denials so revenue does not leak. Our service performs audits of claim submissions to identify common problems and implement preventive protocols.

2. Medical Credentialing Coordination

Credentialing providers across organizational entities during a merger can be unbearably complex. Our medical credentialing services allow us to manage provider enrollment, updates to insurance panels, and compliance documentation across various website portals.

3. Medical Coding Accuracy Programs

Coding audits and coder training are helpful preventive measures to comply with payers. Our medical coding services have plans for accuracy and payer specific protocols.

4. Revenue Cycle Optimization

Our healthcare revenue cycle management services will integrate the processes of billing, credentialing, and compliance into one coordinated function.

Any practice assessing a merger or consolidation should consider reaching out to these services to lower potential risk and time to recover lost revenue following the acquisition.

Looking Ahead: What's Coming in Q4 2025

The consolidation trend won't slow down in the 4th quarter. Here is what to watch for:

1. Increased Dental Consolidation

DSOs will persist in a strong acquisition strategy approach, e.g., we expect 50 to 75 more material DSO platform transactions before the end of 2023.

2.ASC Expansion

Ambulatory surgery center networks will expand. For example, Tenet Healthcare spent nearly $300 million in merger and acquisition activity in the 1st quarter of 2023. Another wave of ASC rollups is coming.

3. Integrating Behavioral Health

The merger of Brightli and Centerstone to form the premier nonprofit behavioral health company illustrates the momentum of continued consolidation in the mental health and substance abuse fields.

4. Hospital System Federalization

Regional health systems will acquire competitors to gain broader geographic footprints and firm up positioning regionally.

5. Digital Health Consolidation

Healthcare IT M&A is up 26% year-to-date. We expect a continued trend of consolidation for EHR, RCM and analytics platforms.

Key Takeaway

Healthcare mergers and acquisitions in the third quarter of 2025 shows that we are experiencing a structural transformation across the medical delivery industry. 367 physician practice transactions, 183 dental practice transactions and over $10 billion in major transactions are not isolated events. This has become the new normal.

For physicians practice this spell one thing - adapt or become extinct.

Whether through consolidation or through a partnership with an experienced medical billing service, practices must access:

- Sophisticated revenue cycle management,

- Compliance knowledge and experience,

- Technology infrastructure,

- Payer relationships, and

- Data analytics capabilities.

Consolidation offers practice opportunity. It also offers risk.

Physician practices that flourish are the practices who understand the change and position themselves accordingly.

Would you like to learn how to strengthen your medical practices position? Then visit our success stories to see how other medical practices have navigated consolidation or visit How our Services work to learn more about medical billing services to support consolidation practices.

A third wave of consolidation is fast approaching for quarter four in 2025. Don't be caught off guard.

Contact Human Medical Billing to schedule a compliance readiness review or learn more about our end-to-end billing and regulatory support services.