Why Medical Billing KPIs Matter in 2025

In 2025, U.S. healthcare revenue cycle management (RCM) has never been more complicated. Expenses are going up, payer regulations are becoming more stringent, and patients are paying increasingly more of the medical expenses. For providers, that means each dollar received is more work and planning than before.

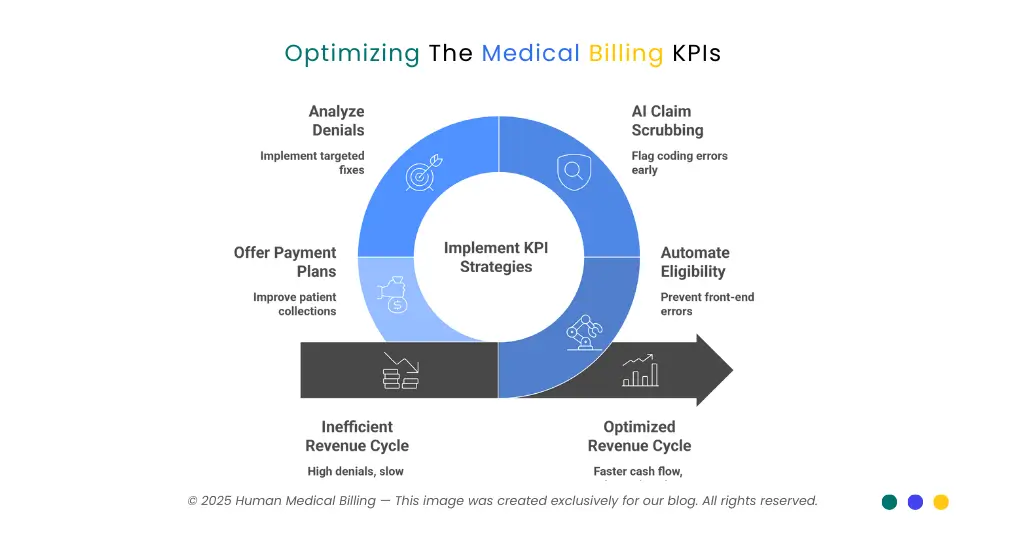

The numbers don't lie, denial rates are 12–15%, patient collection rates are 34-48%, and more than 60% of healthcare organizations indicate that they implement artificial intelligence in some function of their revenue cycle. With all this stress, tracking the right medical billing KPIs is no longer an option - it's about financial survival.

By tracking and enhancing these KPIs, practices can:

- Generate cash flow

- Minimize expensive denials

- Improve patient collections

- Stay current on HIPAA and state prompt-pay laws

Let us consider the most critical KPIs for 2025, the benchmarks, and how to maximize them.

Days in Accounts Receivable (A/R): Your Cash Flow Lifeline

Days in A/R refers to how long it will take a practice to be paid once services are rendered. It is one of the most important financial health indicators.

High performers in 2025 have A/R days less than 30. 31–40 is on the acceptable range to industry groups like MGMA and AAFP. Over 50 days indicates cash flow issues of significant concern.

Formula:

Days in A/R = Total A/R / (Gross Charges / 365)

Example: A firm with accounts receivable of $500,000 and annual charges of $3,000,000 has A/R days of 60.8 - implying enormous inefficiencies.

U.S. context: Medicare has a 14-day minimum payment floor and must pay interest on uncompensated claims older than 30 days. Commercial payers have state prompt-pay laws, typically prompt payment in 30–45 days (e.g., Texas).

Ways to further enhance A/R days:

- Simplify eligibility checking to avoid front-end mistakes

- Use AI-driven tools to track claims in real time

- Offer an early payment discount or incentive to speed up collections

Clean Claim Rate (CCR): First-Pass Excellence

A high clean claims ratio shows that your claims are being paid on the first try - no rejections, no delays. This measure has a direct impact on cash coming as quickly as possible.

In year 2025, it is set at 95% or higher. Most organizations push it to 98%. 85–94% is okay but less than that means that your team is spending too much time on rework.

How to maintain a good CCR:

- Employ artificial intelligence-driven claim scrubbing software that detects coding errors before submission

- Conduct real-time eligibility checks

- Train staff regularly in ICD-10, CPT, and HCPCS coding updates

A one- or two-point raise in CCR will save hundreds of staff hours and significantly accelerate collection.

Denial Rate: Stop Revenue Leakage

Denials are the biggest revenue losers. In the last two years, initial claim denials have increased steadily to 11.8% in 2024 and are likely to hit 12–15% in 2025.

Providers should aim for a denial rate of <5%, and <3% is best-in-class.

Key facts:

- About half of all denials are due to front-end errors (eligibility, demographics, insufficient authorizations).

- Eligibility issues alone account for about 22% of preventable denials.

- AMA has indicated that 27% of previous authorizations are automatically or always rejected.

Methods to lower denial rates:

- Deny breakdown by type and implement targeted remedies

- Automate prior authorization processes

- Utilize artificial intelligence to predict denials and resubmit claims correctly the first time

Example: One U.S. clinic reduced denials from 14% to 4% within a year of installing denial prediction software and saved over $150,000 each year.

Net Collection Rate (NCR): True Revenue Capture

Gross collections are only half the story. For that reason, Net Collection Rate (NCR) is a better indicator - it considers contractual allowances and concentrates on what is collectible.

Equation:

NCR = (Total Collections – Contractual Adjustments) ÷ Total Allowable Charges × 100

Benchmark:

- Healthy performance: 90–95%

- Best practices: ≥95%

If your NCR is falling below 90%, it generally reflects inadequate denial management or lost charge capture. To enhance NCR, you must have better front-end processes, enhanced denial prevention, and underpayment follow-up.

Patient Responsibility Collection Rate

While out-of-pocket patient expenses increase, patient collection stands as one of the biggest healthcare issues.

As of 2025, commercially insured patient collection rates dropped as low as 34.4%, and overall market averages dropped as low as 34–48%. Collection on balances of $7,500 or higher can drop as low as 17%.

Methods to improve patient collections:

- Provide reliable cost estimates early on

- Offer flexible payment terms and online payments

- Collect at the point of service when available

- Utilize patient portals so that payment is easy and transparent

Combos of financial advice with digital payment tools consistently beat the competition in this KPI.

Cost to Collect: Efficiency Score

The cost of money that your business must pay to make one dollar of revenue is the collection cost.

Formula:

Cost to Collect = (Total RCM Costs ÷ Total Collections) × 100

Benchmarks:

- Benchmark: 2–4% of net patient revenue

- Leaders: ≤2%

AI and automation are lowering the cost KPI increasingly. Users of automation are witnessing a mean cost savings of 0.23 percentage points, and case studies show savings of as much as 35% where repetitive manual tasks are reduced.

The Role of Technology in 2025

Technology is now driving RCM performance. AI and automation are no longer in the test lab - they're mainstream.

- AI adoption: Over 60% of the U.S. providers leverage AI in the RCM process.

- Impact: Predictive analytics forecast denials, NLP improves coding accuracy, and AI-facilitated prior auth reduces delays.

- Scale: NBER estimates nationwide U.S. health savings of $200–360 billion annually from AI efficiencies.

Automation of prior authorization alone is turning the game around. According to the AMA, 93% of doctors see care delayed by prior auth, but automation can reduce much of the burden by auto-filling forms, monitoring payer requirements, and sending real-time notifications.

Value-Based Care and KPIs

The traditional fee-for-service standards no longer suffice. In 2023, 45% of payments for U.S. healthcare passed through value-based arrangements, 28.5% with downside risk, and approximately 10% on a capitation basis (HCP-LAN).

That necessitates providers to monitor both financial KPIs and quality metrics, including:

- Readmission rates

- Patient satisfaction surveys

- Preventive care adherence

Practices that combine financial and clinical KPIs onto a single dashboard are most likely to succeed in these structures.

| KPI | Benchmark / Target | Notes |

|---|---|---|

| Days in A/R | ≤30 excellent; 31–40 acceptable | Medicare = 14-day floor; state prompt-pay laws apply |

| Clean Claim Rate | ≥95% (98% stretch) | Errors mainly demographics + coding |

| Denial Rate | <5% target; <3% best | Industry average now 12–15% |

| Net Collection Rate (NCR) | ≥95% leaders; 90–95% healthy | Adjusted for contractual allowances |

| Patient Collection Rate | ~34–48% average | Drops sharply for balances >$5,000 |

| Cost to Collect | 2–4% standard; ≤2% leaders | AI reduces cost by 0.23 pts avg |

FAQ

Good practice maintains Days in A/R at less than 30, and 31–40 is tolerable. Over 50 is a red flag.

Denials are 12–15%, but providers should target <5%, and top performers are <3%.

Collection rates are 34-48% on average, which is far from ideal. Large balances are particularly difficult to collect.

A typical NCR is 90–95%, and high achievers ≥95%.

AI reduces errors, eliminates denials, and automates prior authorization, saving U.S. healthcare as much as $360 billion annually.

Conclusion: The Future of Medical Billing KPIs

Effective management of medical billing KPIs in 2025 is not numbers alone. It is technology deployment, process optimization, and patient-centricity. Providers who utilize AI-driven tools, strengthen front-end processes, and shift to value-based models will witness:

- Quicker cash flow

- Fewer rejections

- Enhanced patient satisfaction Long-term financial stability

Curious to see how your practice measures up? Schedule a complimentary audit with our medical billing experts and start optimizing your revenue cycle today.

start optimizing your revenue cycle today.