At first glance, the Centers for Medicare & Medicaid Services (CMS) 2026 Physician Fee Schedule (PFS) final rule appears to be a minor victory for healthcare providers. There is a well-publicized 3.26% increase in the conversion factor (CF) for most health professionals. After years of fee schedule uncertainty, this represents a welcome positive development.

However, there is a provision buried in the final rule that virtually nullifies that increase for many specialties.

That provision is the 2.5% efficiency adjustment. It is not a straightforward, across-the-board adjustment. It is a much more complex and targeted decrease which will create a significant financial divide in the delivery of medicine. The policy is intended as a structural shift to re-distribute fees and create distinct winners and losers. For surgeons, radiologists, cardiologists and other procedural specialists, it is essentially a stealthy cut in reimbursement, disguised as a technical update.

Below is an explanation of what the 2.5% efficiency adjustment is, how the calculation is structured to eliminate the benefits of the 3.26% increase, and what your practice should expect to do to prepare for it.

Featured Response: What Is the 2.5 % Efficiency Adjustment?

To date, no one has asked, "What is the CMS 2.5% efficiency adjustment?" so we'll provide a response to the question.

The 2.5% efficiency adjustment is a finalized policy in the CY 2026 Medicare Physician Fee Schedule. The adjustment requires a -2.5% reduction to the work RVUs and intra-service times for "almost all non-time-based codes."

Let's break that down further.

1. Who it impacts:

The cut is directed at procedural services. If the service is valued by the process itself (e.g., a surgical procedure or diagnostic image), and not the time spent with the patient, then the service itself will have had its core value reduced by 2.5%.

2. Who is unaffected:

The cut does not impact time-based codes. This includes most E/M services, telemedicine, and maternal care codes. These services are not being decreased in value.

CMS states that the basis for the 2.5% efficiency cut is to adjust for efficiencies gained in performing medical services that have accumulated over time. The agency states that, based upon a five-year review period, physicians have become 2.5 % more efficient in performing procedures, and this adjustment merely reflects that trend.

The efficiency adjustment is not a one-time event. CMS intends to make this adjustment on a three-year cycle, thereby adding another layer of recurring financial risk for procedural medicine.

The Math: How a 3.26% "Raise" Vanishes

This is where things get complicated, and where many practices may misinterpret their 2026 revenues. One cannot simply add the 3.26% raise and subtract the 2.5% cut.

The reason is as follows. The 2.5% efficiency cut is applied to the RVU (work unit of measure) prior to the payment being calculated. The RVU is the base unit of measure for a service, and the payment is calculated off of the RVU.

Here is a simplified version of the basic Medicare payment formula:

(Work RVUs + Practice Expense RVUs + Malpractice RVUs) x Conversion Factor = Final Payment

The 3.26% "raise" increases the Conversion Factor (dollar amount).

The 2.5% cut reduces the Work RVUs (unit value).

Let us see how these two values interact.

1. Winner: A Time-Based Service (Example: Primary Care E/M Visit)

The time-based service is excluded from the efficiency cut. It receives the full benefit of the increased Conversion Factor.

- 2025 Calculation: (5.0 Total RVUs) x ($32.3465 CF) = $161.73

- 2026 Calculation: (5.0 Total RVUs) x ($33.4009 CF) = $167.00

- Net Result: A full 3.26% raise.

2. Loser: A Non-Time-Based Service (Example: Surgical Procedure)

Non-time-based services receive the efficiency cut. Their base RVU value is adjusted downward prior to application of the increased CF.

- 2025 Calculation: (20.0 Work RVUs) x ($32.3465 CF) = $646.93 (showing only work RVU portion for simplicity)

- 2026 Calculation:

First, the Cut: 20.0 Work RVUs x 0.975 = 19.5 Work RVUs (The service itself is now worth less)

Then, the "Raise": (19.5 Work RVUs) x ($33.4009 CF) = $651.32

- Net Result: A 0.67% raise.

As we can clearly see, the 2.5% efficiency adjustment effectively eliminates the 3.26% payment update. A 0.67 % "raise" in today's economic climate represents a net negative payment cut. The policy thus ensures that procedural medicine will actually receive fewer dollars in real terms than last year.

| Policy Provision | Who It Affects (Winners) | Who It Affects (Losers) |

|---|---|---|

| Conversion Factor (CF) Update 1 | All providers get a "raise" on paper. (Non-APM: +3.26%; APM QP: +3.77%) | No one. This part is a nominal increase for everyone. |

| 2.5% Efficiency Adjustment 3 | Cognitive & Time-Based Services:

• Behavioral Health • Maternity Care • Telehealth Services (These services are exempt from the cut and receive the full 3.26% raise.) | Procedural & Non-Time-Based Services: • Surgery (all types) • Cardiology • Radiology • Orthopedics • Gastroenterology (These services have their work RVUs cut by 2.5%, erasing the CF raise.) |

| Net Financial Impact | Net Positive: These specialties will see a real increase in payment for their core services. | Net Negative: These specialties will see payments stagnate or effectively decrease after inflation. |

The Great Re-Allocation: A Deliberate Financial Shift

While the 2026 PFS Rule is a significant change to physician reimbursement, it is not a mistake – it is a planned, intentional wealth transfer.

CMS has chosen to protect the time-based E/M codes from the 2026 PFS cut, while reducing payments to procedural based specialties by taking budget neutral dollars from those specialty’s procedural codes and allocating those dollars to primary care and cognitive service codes.

This is not a new approach; however, the 2.5% efficiency adjustment is the most extreme measure taken to date by CMS to change physician behavior and transition the industry away from traditional fee-for-service models.

The 2.5% adjustment is the “stick” and it is paired with several other initiatives in the 2026 PFS Rule.

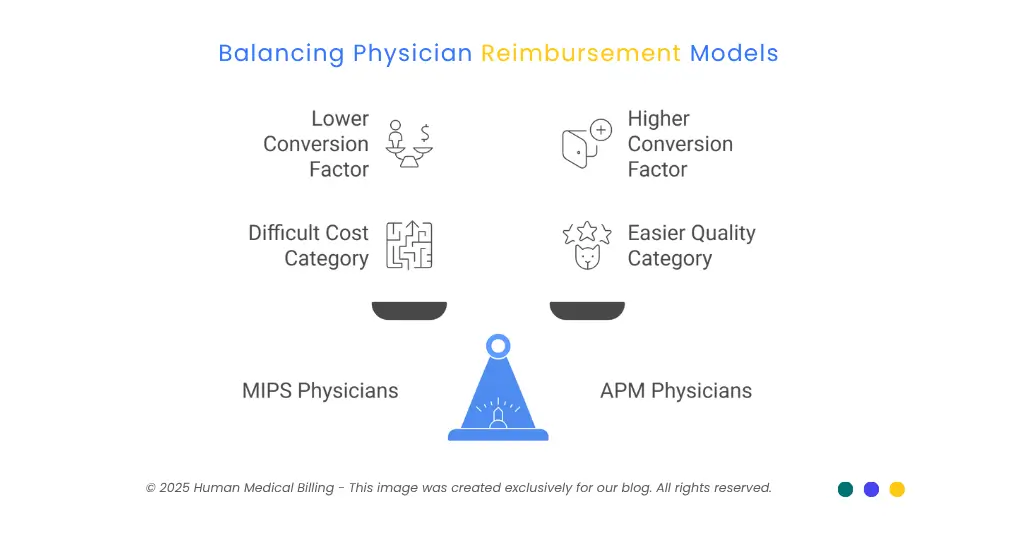

1. The MIPS "Trap":

CMS is going to continue to raise the bar for physicians participating in MIPS. The threshold for physicians to earn enough points to avoid a penalty remains 75 points. Additionally, the "Cost" performance category, which is difficult for specialist to influence, is being weighted equally to the "Quality" performance category (at 30%) to create an almost impossible barrier for physicians to avoid a MIPS penalty.

2. The APM "Carrot":

The 2026 PFS Rule establishes two separate conversion factors: a lower factor for MIPS/Other Physicians ($33.4009) and a higher factor for physicians in Advanced Alternative Payment Models ($33.5675).

Now let's connect some of the dots:

As a surgeon, CMS is:

Reducing the value of your core procedural codes via the 2.5% efficiency adjustment. Making it more difficult for you to avoid a MIPS penalty. Providing you with the only path to receive a higher payment if you join an Advanced APM.

This is a high stakes financial play to make the current system so unbearable that joining an Advanced APM becomes the only viable option.

What Steps Can Your Practice Take to Prepare for the 2.5% Efficiency Adjustment?

You cannot wait to see what happens in 2026. You need to act today.

Here is a Plan.

1. Run a CPT-Level Financial Impact Analysis

Don't rely on the headlines. Your practice must do its own financial impact analysis.

- Pull a report of your top 100-200 CPT codes from the last year.

- Identify all of the CPT codes that are not time-based.

- Apply a 2.5% reduction to the 2026 Work RVU for each of these codes.

- Calculate your expected 2026 revenue with the new RVUs and the new $33.4009 conversion factor.

The only way you will truly understand how this change will affect your 2026 cash flow is to run your own CPT-level analysis. CPT level financial analysis is a critical component of professional healthcare revenue cycle management services.

2. Audit and Defend Your E/M Coding

Time-based E/M codes are the most stable and valuable part of your revenue. As such, payers are aware of this fact and will scrutinize the documentation supporting these claims.

- Audit Your Providers: Are your providers documenting and reporting all of the time spent providing E/M services? Often, we have found that providers are under-documenting and therefore not collecting the maximum amount of reimbursement for their time-based services.

- Strengthen Documentation: Now is not the time to be complacent with your documentation. Ensure that your documentation is complete and supports the reimbursement you are requesting. Payers will likely review your documentation as part of their denial process. Denial management services can provide you with an expert opinion on why your E/M claims were denied and develop a plan to appeal the denial.

3. Review All Payer Contracts

Although the 2.5% efficiency adjustment is a Medicare policy, many commercial payers watch and often mirror Medicare's changes to save themselves money.

- Review your commercial contracts. Are your commercial contracts tied to the Medicare fee schedule?

- Be prepared to defend and negotiate your contracts with commercial payers who may want to adopt the 2.5% work RVU reduction as well.

- Update Your Medical Credentialing Services. With changes to your contracts and possible disputes over payment, now is the best time to review your medical credentialing services to ensure that you are not experiencing any delays or issues during contract negotiations.

4. Evaluate Your RCM Strategy

With increasing complexity of rules and regulations and increased claim denial rates, in-house teams are finding it increasingly difficult to maintain compliance.

- Your Coding Team Needs to be Experts! The accuracy of your medical coding services will directly affect your ability to collect reimbursement for time-based services or have the payment reduced for non-time-based services.

- Your Accounts Receivable Team Needs to be Prepared to Fight for Every Dollar! With decreasing net margins due to the 2.5% reduction in procedure fees, your accounts receivable team will need to be more proactive in defending your claims and negotiating with payers.

- Many Practices are Now Using AI Medical Billing Tools or Full Service Partnerships to Manage the Complexity!

The largest financial implications of the 2026 PFS rules will be a 2.5% reduction in reimbursement to physicians and other practitioners who utilize procedural techniques. The reduction is targeted directly to procedural medicine and serves as a direct indicator by CMS that fee-for-service (FFS) has become a financially unsustainable model for physician compensation and reimbursement.

In order to mitigate the effects of the 2026 PFS rules, proactive analysis of potential changes; a solid coding defense of all claims submitted for payment; and a well-designed and implemented revenue cycle management plan are essential components of protecting your practice from the adverse impacts of these rules.

If you have concerns regarding the potential financial impact of the 2026 PFS rules on your practice, please call us today to learn more about our medical billing services and how we can assist your practice to adapt to the ever-changing financial landscape facing physicians and other healthcare providers today.

To remain informed of future updates, follow our Xpert billing blog or view our success stories which detail how we assist practices such as yours to successfully navigate a changing financial environment.

Contact Human Medical Billing to schedule a compliance readiness review or learn more about our end-to-end billing and regulatory support services.