Most medical practice owners and revenue cycle managers track changes in patient volume and/or changes in the policies of payers to be able to better anticipate the future of their finances. In 2026, one of the primary factors that will potentially influence your revenue cycle is an external factor: Federal Reserve's interest rate policy.

As a general rule, the economy being robust benefits healthcare providers; however, particular fiscal actions within the economy can create areas of stress in the insurance market. Currently, major health care industry analysts and credit rating agencies are tracking how interest rate cuts could impact health insurer profitability. As with most other industries when a health insurer faces financial difficulties, those pressures will likely flow downstream to hospitals, private practices, and clinics.

This article will assess the overall economic environment for 2026 and provide you with recommendations on how medical practices can fortify their revenue cycles in anticipation of a volatile year.

The 30-Second Summary (Executive Overview)

1. The Forecast:

The Federal Reserve will likely lower benchmark interest rates in 2026.

2. Mechanism:

Health insurers invest billions of dollars into their reserve funds. As the interest rate drops on those investments, it is possible that the investment return (yield) will drop, and this would be one less source of income for the health insurer.

3. The Potential impact:

With reduced income from investments, analysts believe that health insurers may use the underwriting discipline approach to generate profits by being stricter in the way they handle claims - which could lead to an increase in how often claims are denied.

4. The Defense:

Regardless of changes in the economy, healthcare providers should focus on maintaining tight control over their healthcare revenue cycle to avoid losing money due to revenue leakage.

Understanding the "Float": How Rates Affect Payer Profits

To begin understanding potential friction in 2026 you must first analyze the 2026 Insurance Business Model. Payers generate profits through two major engines of profitability:

- Underwriting Income: Premium revenue earned by insurers after subtracting claim payments and administrative expenses.

- Investment Income: Insurers retain a large amount of money (the "float") to fund future claims. This float is typically invested in fixed income securities such as short term bonds.

The Economic Context

When interest rates increase, the earnings for these types of investments tend to be higher. As an example, health insurers in 2024 generated an average investment return of 4.16%. That was the highest rate of return on investment for health insurers in over a decade, according to the data reported by New England Asset Management. A portion of this investment return can serve as a buffer for increasing medical costs (medical loss ratios).

The Shift

Moving into 2026, the outlook for the economy is changing. The Federal Reserve is indicating a possible reduction in the interest rate that it will be using as a basis for loans. According to S&P's Global Ratings, if this happens, the yield on U.S. Treasury bonds with a maturity of 10 years may fall.

If the forecasts are correct, it appears the 'cushion' provided by historically high investment returns could shrink. In this case, when investment returns drop, the pressure to generate enough underwriting revenue through collecting premiums vs. paying claims will increase.

What the Data Says: Key Analyst Projections

Financial analysts have attempted to measure just how much insurance companies will be affected by such a large drop in investment income as described above.

According to an analysis by Leerink Partners, (as reported by industry media):

Investment income was about 0.6% of UnitedHealth Group's 2.1% operating earnings in the third quarter of 2025.

Although this number is relatively small, considering the high volume nature of the health care insurance business, the loss of this income stream could result in billions of dollars for health insurers; therefore, they would need to address the loss in income through:

- Pricing adjustments on premiums.

- Solutions to improve operational efficiency.

- Solutions to contain costs.

Whit Mayo, Senior Managing Director of Leerink Partners stated that the lower rates are "not a helpful headwind" given the already elevated costs in the healthcare system.

Potential Downstream Effects on Providers

While it cannot be guaranteed that rate cuts will result in an increase in denied claims, the trend of "hard markets" (the time period when the insurance company is less profitable), has shown that administrative controls tighten.

1. Enhanced Scrutiny on Claims

As profit margins decrease, payers invest in more sophisticated technologies to validate claims. This can include:

- Advanced Automated Edits: The use of more advanced algorithms which will automatically flag claims due to minor errors within the claim's coding.

- Complex Claim Adjudication: An enhanced review of medical necessity standards.

2. Vulnerability of Non-Profit Payer

Fitch Ratings has noted that non-profit payers may be the most affected by the decline in investment income, since many non-profits have thinner operating margins than their for-profit competitors. Brad Ellis, senior director at Fitch, expects these organizations to take "some risk out of their portfolio", resulting in a more conservative financial strategy.

For providers, having to deal with this type of more conservative payer often results in being subject to tighter prior authorization requirements and potentially longer payment cycle times.

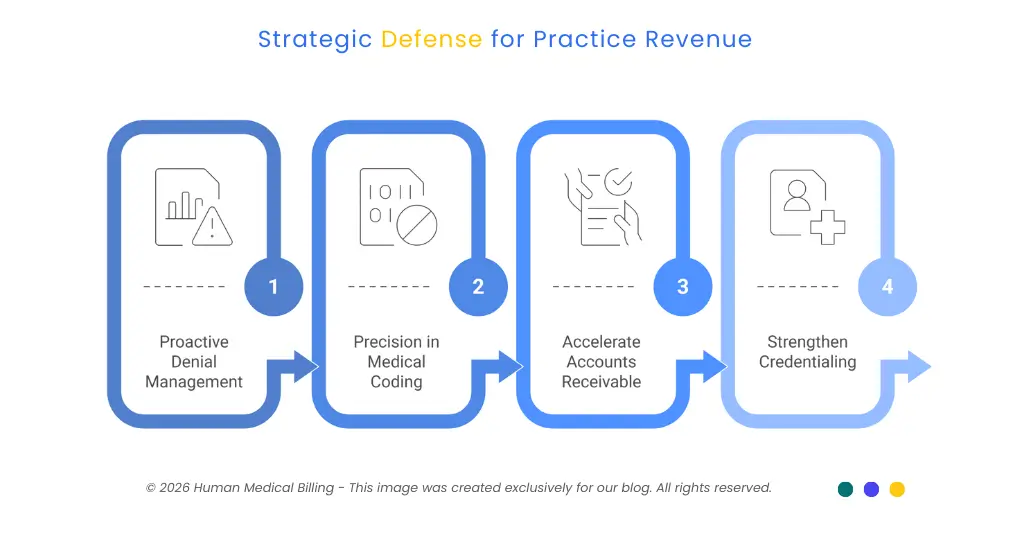

Strategic Defense: Protecting Your Practice Revenue

Regardless of how many times the Federal Reserve may cut interest rates, a key to success for medical practices will be developing a revenue cycle that is resilient to fluctuations in payer reimbursement.

1. Proactive Denial Management

If you encounter growing administrative barriers, you can no longer rely on reactive billing to resolve these obstacles. A proactive approach to deny management is needed; this includes both the appeal of denied claims and the analysis of what was done wrong to correct the upstream processes.

- Action: Review the top five reasons for claim denials for each month. Was the reason eligibility? Were there errors in coding? Was authorization missing?

2. Precision in Medical Coding

Payers are likely to begin utilizing Artificial Intelligence to audit claims. Your coding will have to be as close to "audit-proof" as possible to protect against future claw backs and technical denials. The use of professional medical coding services will ensure that clinical documentation is adequate to support the codes that were submitted.

3. Accelerate Accounts Receivable (AR)

The cash flow of any business is critical when an economy is shifting. Medical accounts receivable services should aggressively follow up on claims between 30 and 60 days old to ensure that they do not age into the uncollectable bucket.

4. Strengthen Credentialing

As we all know, administrative delays most commonly begin at the enrollment phase. Maintaining the accuracy of provider information through the provision of a complete and timely medical credentialing service will prevent payers from withholding payment because of "provider not found" errors.

The Role of Technology and Expertise

The use of artificial intelligence (AI) medical billing solutions has become increasingly popular as it helps many practices to determine the likelihood of a successful claim prior to submitting it for payment. The AI will also detect possible errors that a human could potentially overlook.

Technology on its own typically does not provide a solution to the complexities of payers' contract terms. An expert RCM partner such as Human Medical Billing can offer the best of both worlds. A partner with both the experience and expertise to utilize advanced technology while understanding how the economy is affecting payer contracts.

As an example, we follow changes within the macroeconomic trends which allow us to adapt our billing strategy accordingly so that our clients have claims that are free from errors, compliant with all applicable regulations and paid out in a timely manner.

Comparison: Payer Risk Profiles

Understanding which payers are under the most pressure can help your front-office staff prioritize authorizations and verification.

| Payer Segment | Financial Sensitivity | Potential Operational Impact |

|---|---|---|

| National For-Profit | Moderate | diversified revenue, but under shareholder pressure. Expect automated audits. |

| Regional Non-Profit | High | Higher reliance on investment returns. May tighten prior authorization rules. |

| Government Plans (MA) | High | Facing separate pressures from policy changes and potential tax law adjustments. |

FAQs: Economic Trends & Medical Billing

It is unlikely. Lower interest rates are normally beneficial to borrowers but hurt the ability of insurance companies to earn money through investments, and therefore they will likely increase premium payments rather than decrease them in order to keep their financial condition stable.

It can affect the financial health of the companies that pay you. When there is a "squeeze" in the way that insurance carriers generate their investment income, it has historically led them to find ways to reduce costs (which ultimately leads to a tighter reins on claims processing).

Focus on "clean claim rate" metrics, and the use of expert medical coding services and proactive denial management services will be your best defense against an insurance carrier's tightening of its policies regarding how claims are processed.

Conclusion: Control What You Can

The macro-economic conditions of 2026 (as determined by the actions of the Federal Reserve and the fluctuations in bond yields) introduce a new level of uncertainty to the Healthcare Industry. We cannot affect the interest rate but we can ensure that the claims we file have the highest possible quality.

The tighter your revenue cycle processes are today, the better protected your practice will be from financial pressures of the future.

Ready to proof your practice against economic volatility?

Human Medical Billing helps you navigate through complex payer systems with confidence. Our services range from seamless medical credentialing services to aggressive accounts receivable recovery services. We are your partner in financial health.

Please visit our contact us page for a consultation, read some of our success stories or follow the Xpert Billing Blog to learn more about our approach.

Contact Human Medical Billing to schedule a compliance readiness review or learn more about our end-to-end billing and regulatory support services.