Introduction

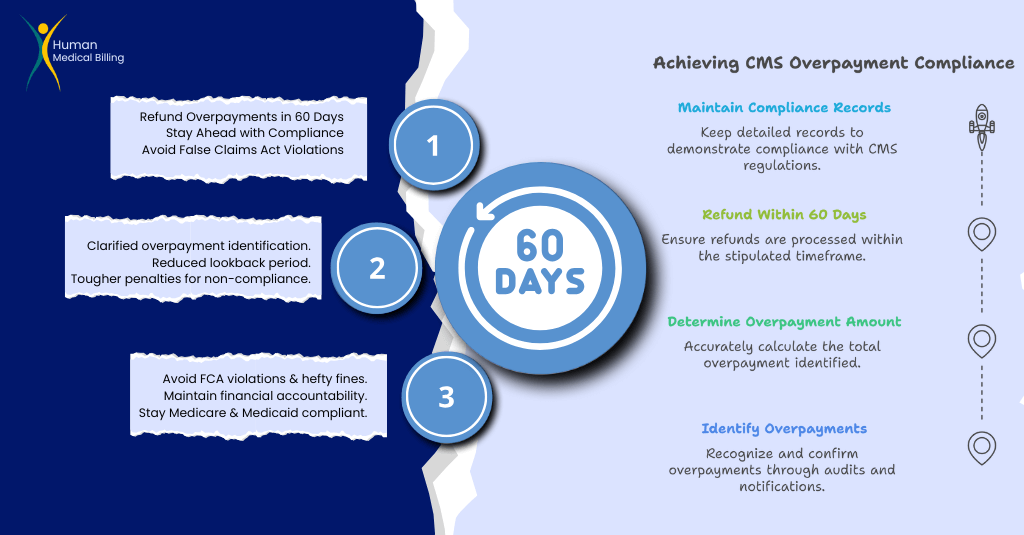

The Centers for Medicare & Medicaid Services (CMS) have revised the 60-day overpayment rule. The rule is extremely significant for medical billing services and healthcare providers. The rule keeps everything organized, removes fraud, and makes proper Medicare and Medicaid payments.

Healthcare providers must know the new CMS 60-day overpayment rule so that they are not fined and maintain their finances in good condition.

The following blog provides a clear idea about the new rule, what is it, and the best way to follow it.

What is the 60-Day Rule for Medicare Overpayment?

The 60-day rule is a ACA mandate that requires that medical providers make refunds of overpayments made under Medicare or Medicaid within 60 days of identification.

The penalties for violating this rule include possible FCA violations, substantial fines and in some cases, criminal charges. The purpose of this intended standard is to ensure that there is financial accountability and to prevent fraudulent billing by ensuring that providers are fiscally responsible.

Why is the 60-Day Rule Important?

- It protects Medicare from fraud and abuse.

- It prevents providers from holding unearned funds.

- It makes healthcare organizations accountable for billing.

- It is consistent with federal initiatives to enhance Medicare and Medicaid monitoring.

If a provider fails to refund an overpayment in a timely manner, the entire amount is a legal obligation under the False Claims Act.

CMS Rules for Overpayments

What is an Overpayment?

An overpayment is when a health care provider is paid more than they are owed for a service or treatment. Overpayments are caused by:

- Incorrect billing or coding (e.g., upcoding, billing duplicates)

- Duplicate payments to Medicare

- Payment to ineligible recipients or for non-covered services

- Incorrect submission by human or systemic error

- CMS Overpayment Compliance Requirements

Under the revised CMS 60-day overpayment rule, healthcare providers are required to:

- Identify overpayments via internal audits, claim review, or payer notification.

- Determine the precise amount overpaid within a reasonable timeframe.

- Refund the overpayment to Medicare or Medicaid within 60 days of identification.

- Maintain records to establish they are in compliance with the rule.

Providers that fail to repay additional money within 60 days could have serious legal issues. They could include fines, being barred from Medicare, and violating the FCA regulations.

What is the New Overpayment Rule?

New revisions of the CMS 60-day overpayment rule make the definition of identifying overpayments clearer and enhance the process for adhering to the rules. The key changes are:

1. Clarification on "Identification"

Before, providers did not know when the 60-day clock begins. CMS has now clarified that “identification” means:

- When a provider would have known or should have known about the overpayment through reasonable diligence.

- This would include the results of internal audits, notification from the payers, or self-identification.

If a provider waits until later to examine possible overpayments, CMS could apply the 60-day time limit retroactively based on the date the overpayment should have been identified.

2. Reduced Lookback Period

Providers were initially required to refund six year’s worth of excess payments. The new regulation reduces the period to make it more manageable for healthcare organizations to comply.

3. Tough Penalties and Fines

Failure by a provider to repay an overpayment in 60 days may result in:

- Violations of the False Claims Act

- Up to $11,000 fine per claim

- Exclusion from Medicare and Medicaid programs

- Criminal prosecution in severe situations

This illustrates the need for automated denial management and medical billing services to avoid compliance problems.

What is a provider to do if they identify an overpayment?

When a provider identifies an overpayment, they must act promptly to:

- Verify the mistake by conducting an internal audit.

- Compute the overpayment amount correctly.

- Ask for repayment through Medicare’s refund process.

- Document everything to support that they are in compliance with CMS regulations.

If a provider fails to repay within 60 days, CMS may conduct an audit, impose penalties, or bring FCA charges.

How Can Providers Meet the CMS 60-Day Overpayment Rule?

To meet the requirements, healthcare providers must act in a proactive manner:

Use Automated Overpayment Detection

Medical billing software powered by artificial intelligence can detect and prevent overpayment errors before they become a problem.

Perform Regular Internal Audits

Regular claims audits and billing reviews can identify errors early and encourage CMS guideline compliance.

Streamline the Refund Process

Detailed repayment workflow ensures overpayments are returned within 60 days penalty-free.

Offer Continuing Compliance Training

Medical billing and coding personnel should be brought up to speed with the most current CMS guidelines to avoid mistakes.

For expert assistance, look to our Healthcare Revenue Cycle Management Services to optimize billing accuracy and compliance.

Final Thoughts: Stay Current with CMS Compliance Requirements.

The CMS 60-day overpayment rule is a rule that healthcare providers must comply with. With less flexibility in the rules and fewer days to review, providers must do:

- Timely identification of overpayments

- Quick action to refund overpayments

- The use of AI in billing and fees, and trained billing personnel knowledgeable in CMS rules.

Why Human Medical Billing?

Our specialists are medical billing compliance experts, helping healthcare providers reduce claim denials, improve revenue cycle management, and avoid CMS penalties.

Stay compliant, protect your revenue, and steer clear of FCA offenses!

If you are looking for professional overpayment resolution services, please contact us at here.